Springfield Microfinance Bank

Finance

2025

Freelance Product Designer

Overview

Bringing Springfield Bank Online

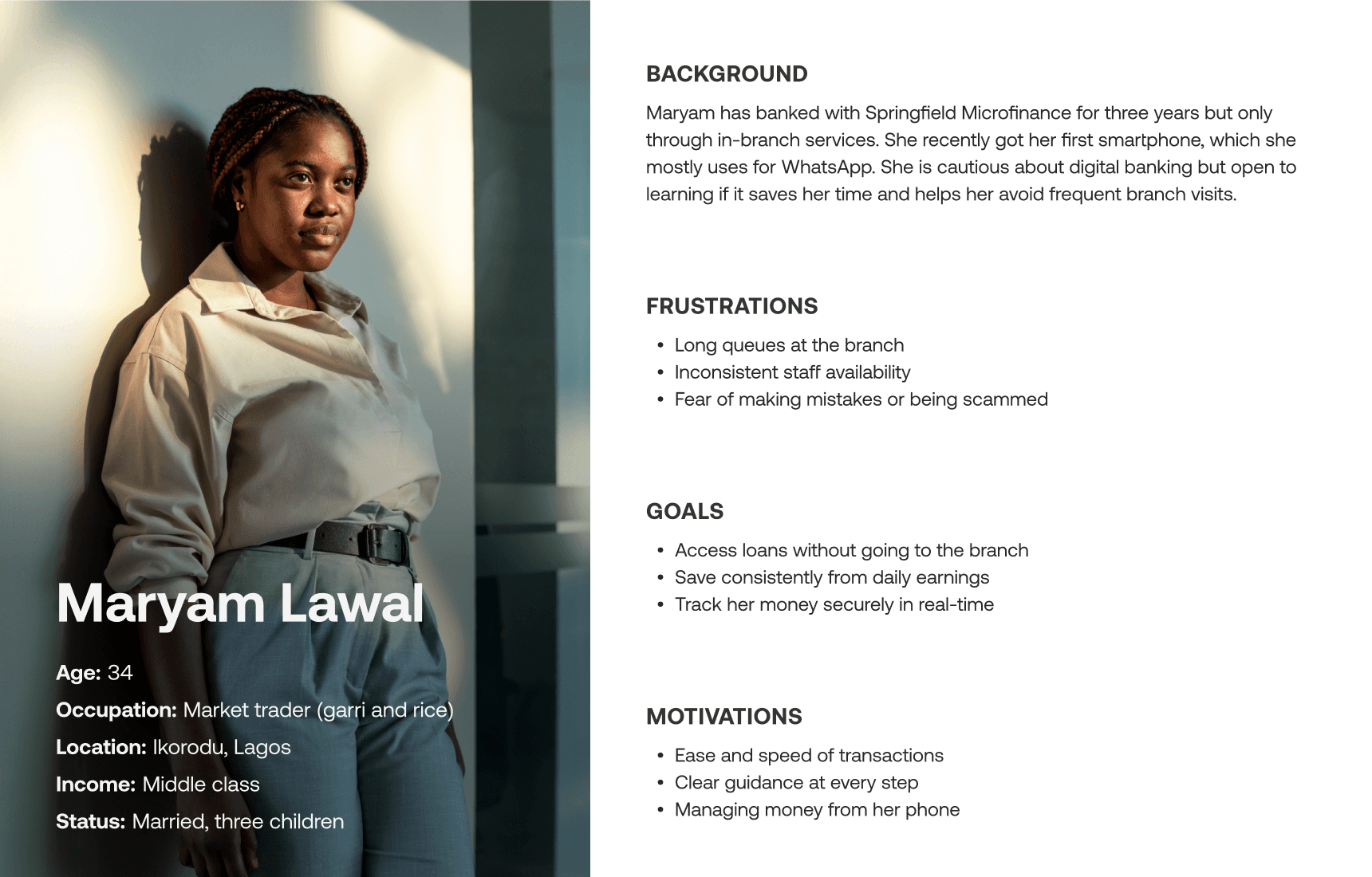

Springfield Microfinance Bank is a licensed bank in Lagos that mainly serves informal workers like market women, artisans, and riders. Until recently, every service was in-branch only. Customers had to come in to perform every transaction they needed. The bank wanted to change that, and that is what led to their digital transformation.

The Problem

Customers Spent Too Much Time Queuing

Springfield’s customers had to come to the branch for every single thing. They queued to open accounts, check balances, or make transfers. This took time, and most of their customers are people who work all day and can’t afford long delays. It also made it hard for the bank to grow because the branch could only handle so many people.

Design Solution

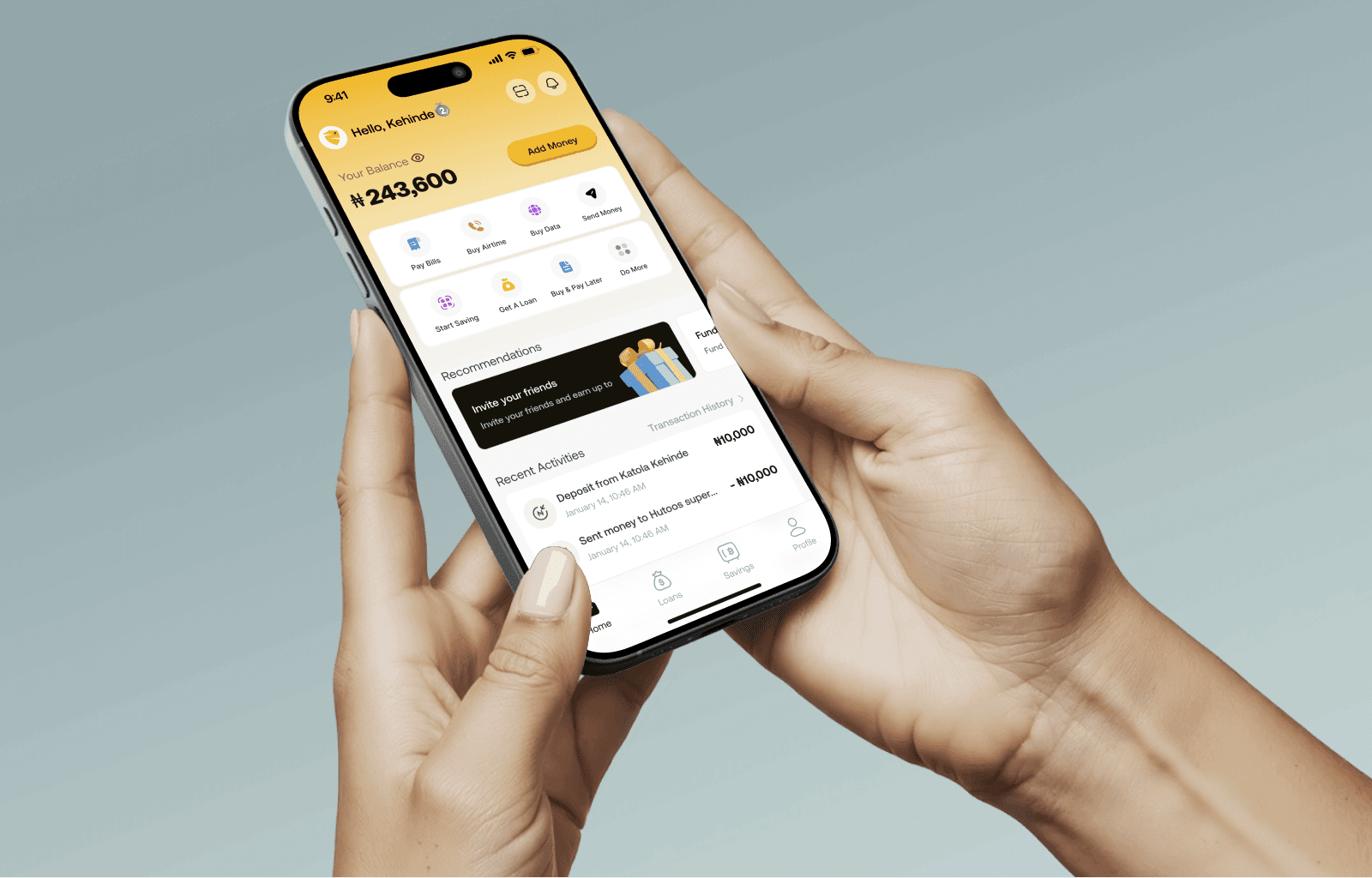

Designing Springfield’s First Digital Banking Experience

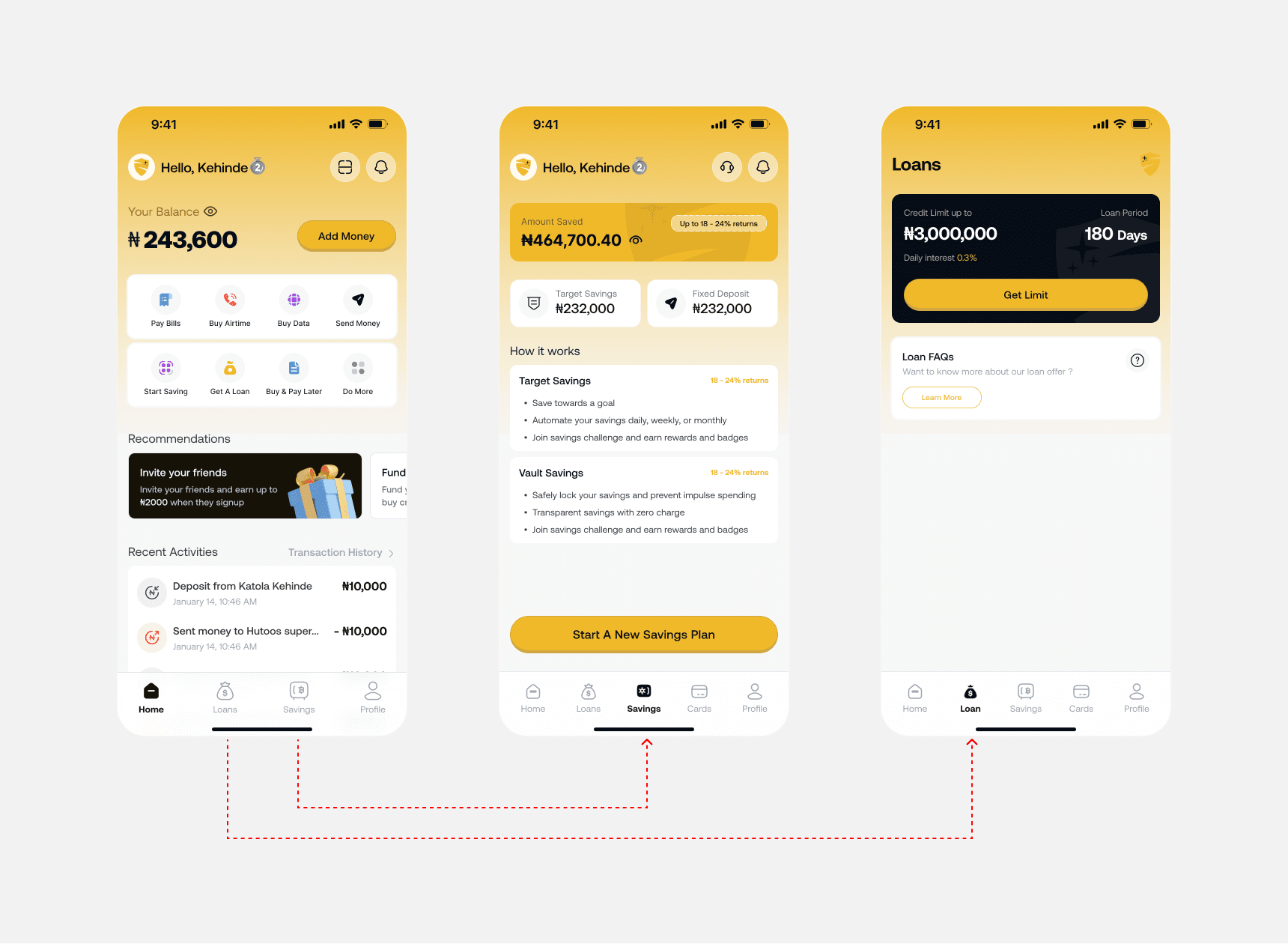

We created Springfield’s first full digital banking system so customers could handle their banking directly on their phone. The experience was designed to feel easy and familiar. We integrated large buttons, clear instructions, and progress indicators for things like opening an account, completing KYC, or applying for a loan. The most common actions sit on the dashboard so users don't spend time searching. On the bank’s side, we built a web dashboard that staff can use to manage customers, track loans, assign roles, and handle account issues without calling the IT team. Everything is now in one place. This helps the bank work faster and grow without being limited by the physical branch

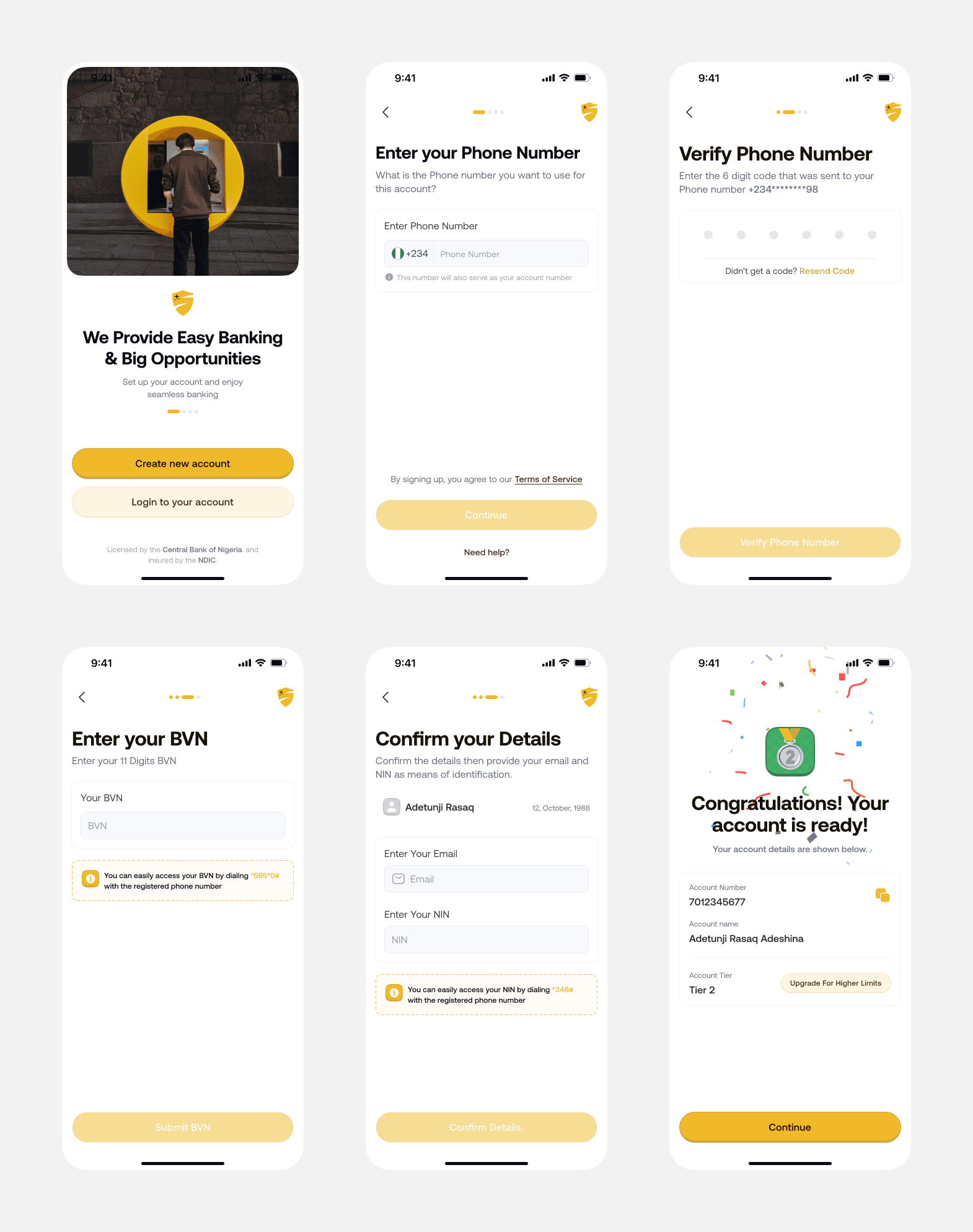

User Onboarding: A Simple, Step by Step Welcome for First-Time Users

Onboarding our users had to feel easy and familiar, especially because many users would be trying digital banking for the first time. The flow guides them step by step, starting with their phone number, then BVN and NIN so they don’t have to enter too many details manually. After that, they complete a quick face verification to confirm their identity. Each stage is simple, clear, and designed to reduce stress and build trust before they land on the home dashboard.

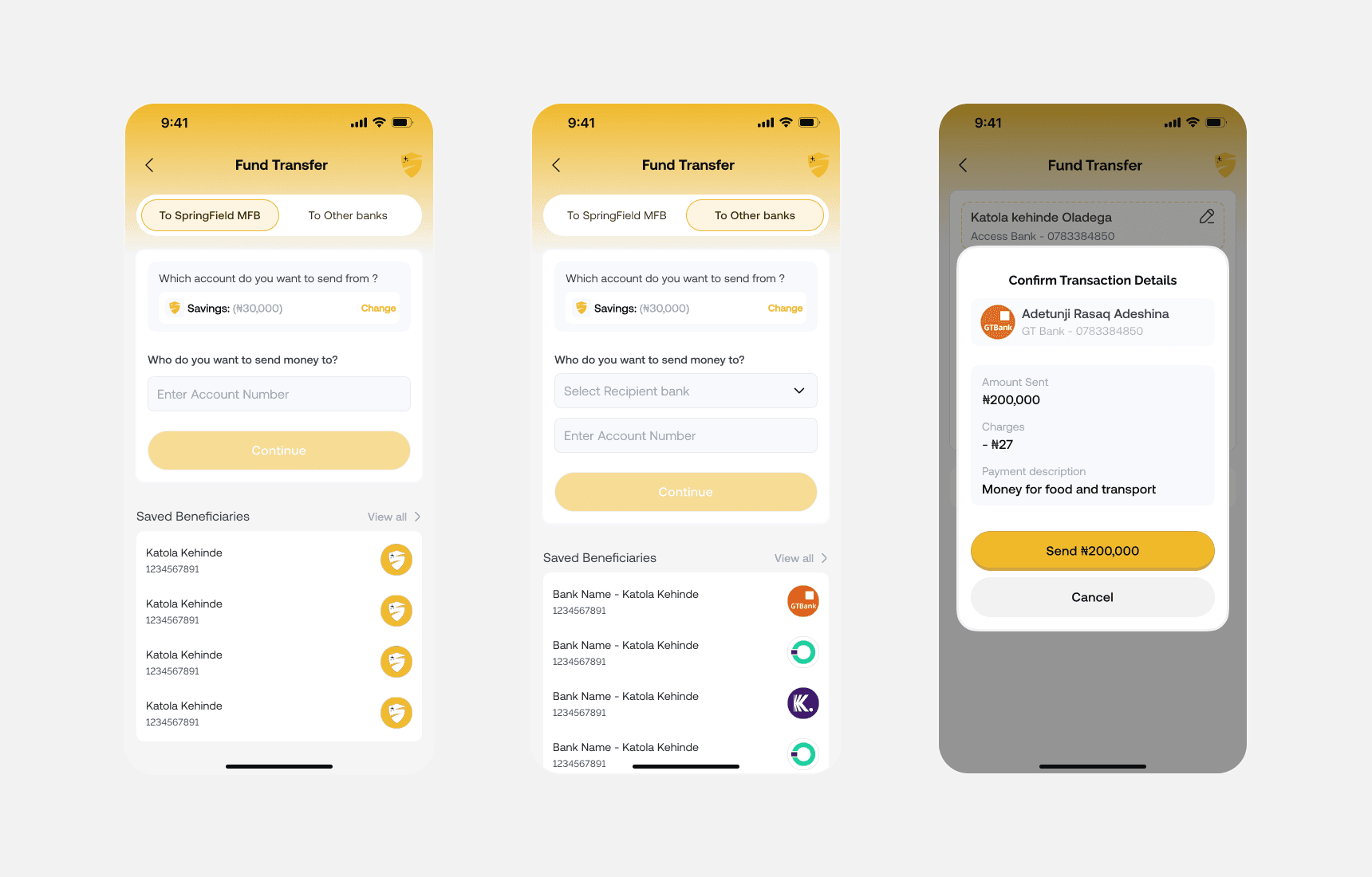

Money Transfer : A Fast and Trustworthy Way to Send Money

Money transfer is one of the main actions for our users, so we focused on speed, clarity, and security. The flow starts and ends cleanly, with real-time validation, clear prompts, and a reassuring confirmation at the end.

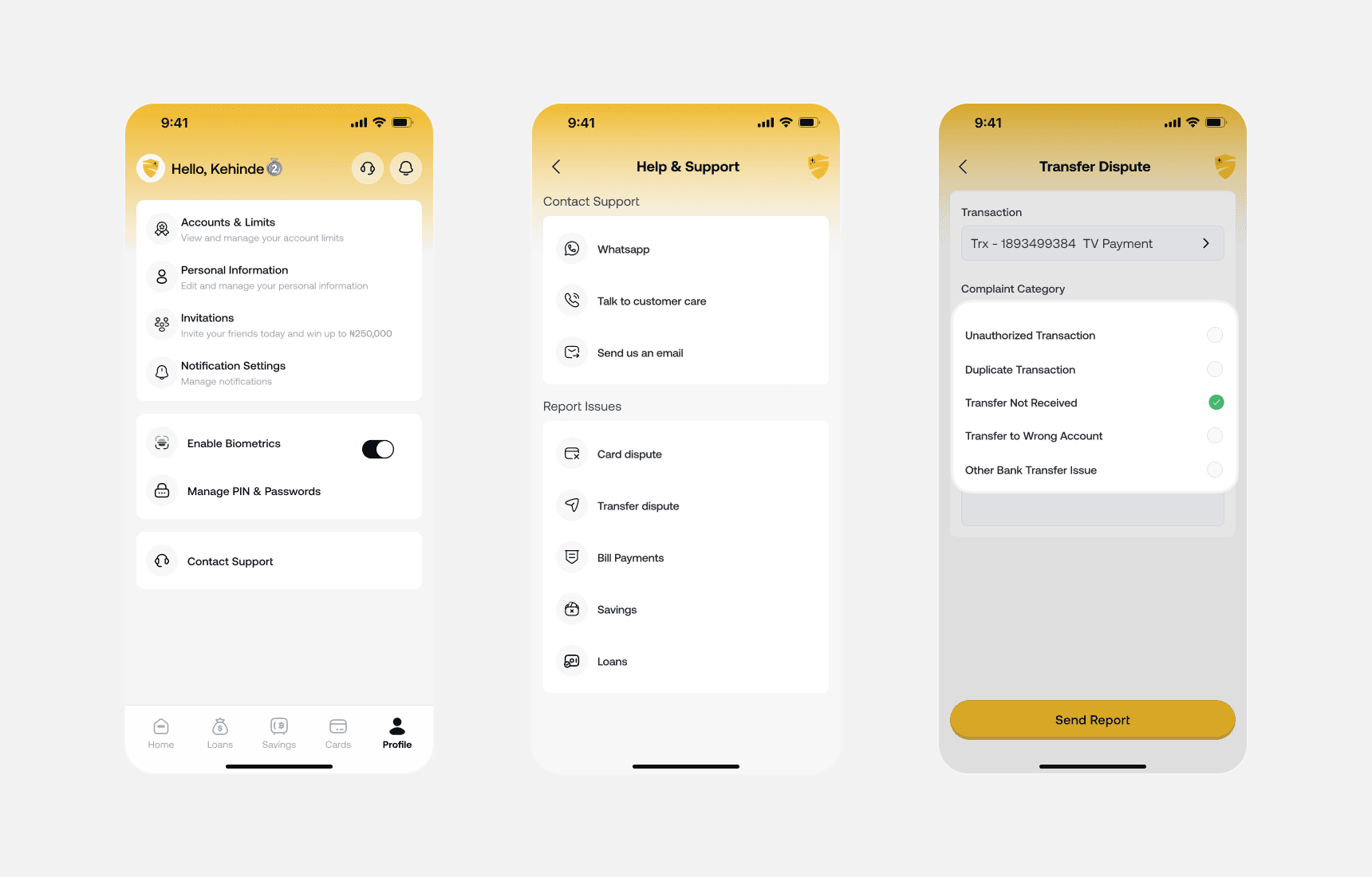

Help and Support: Fast, Simple Problem Resolution for Every User

Help and support can determine whether a user stays or gets frustrated and leaves. So we designed Springfield’s support flow to feel quick and stress free. Users can contact customer care or report any issue directly inside the app.

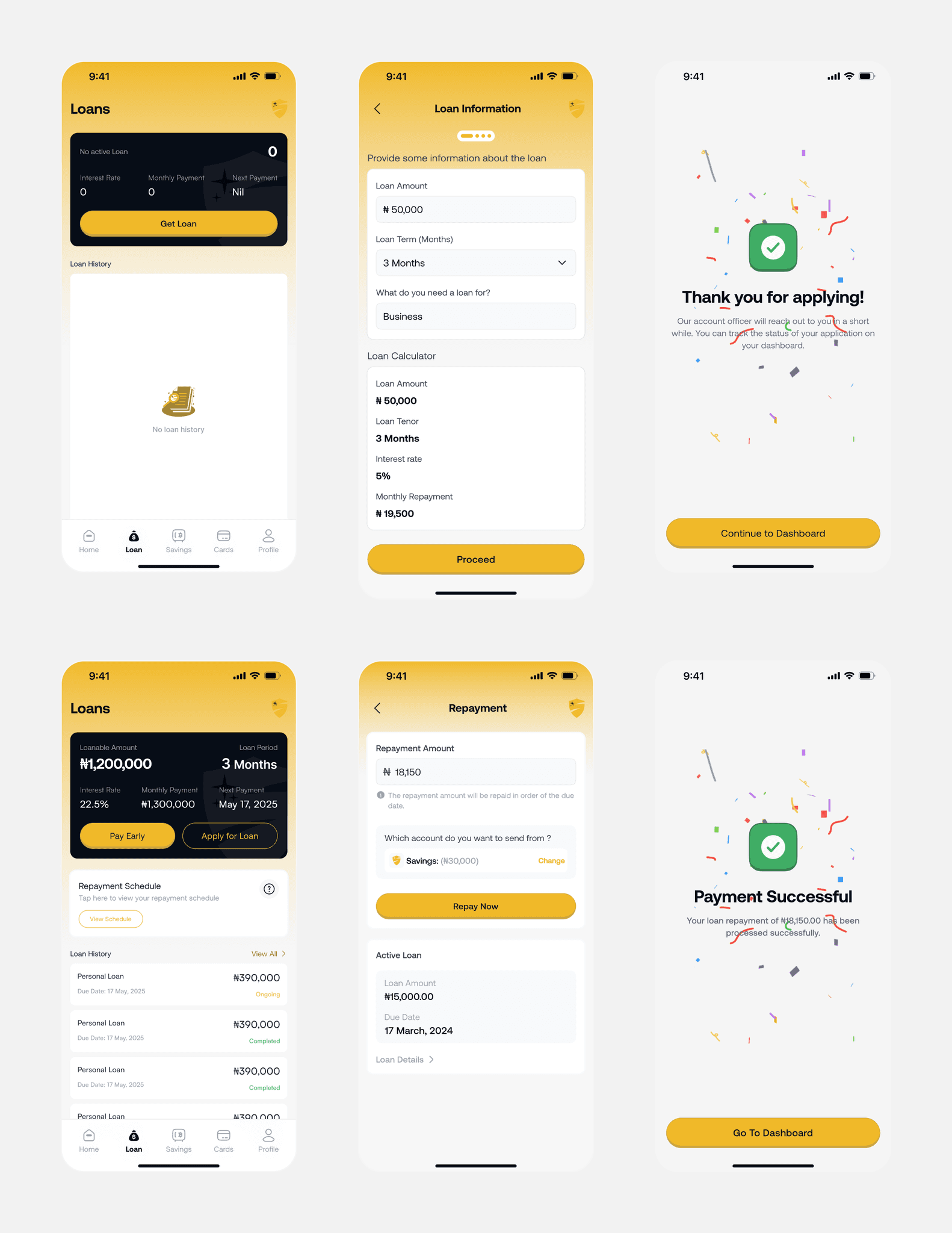

Digital Loans: Borrowing and Repayment Made Easy

The loan feature makes borrowing and repayment simple. On the Loan dashboard, users can see their loan options, outstanding balances, and how far they’ve gone with repayment. They can apply in small, easy steps and repay directly from the app, which removes extra stress for users and helps the bank receive payments on time.

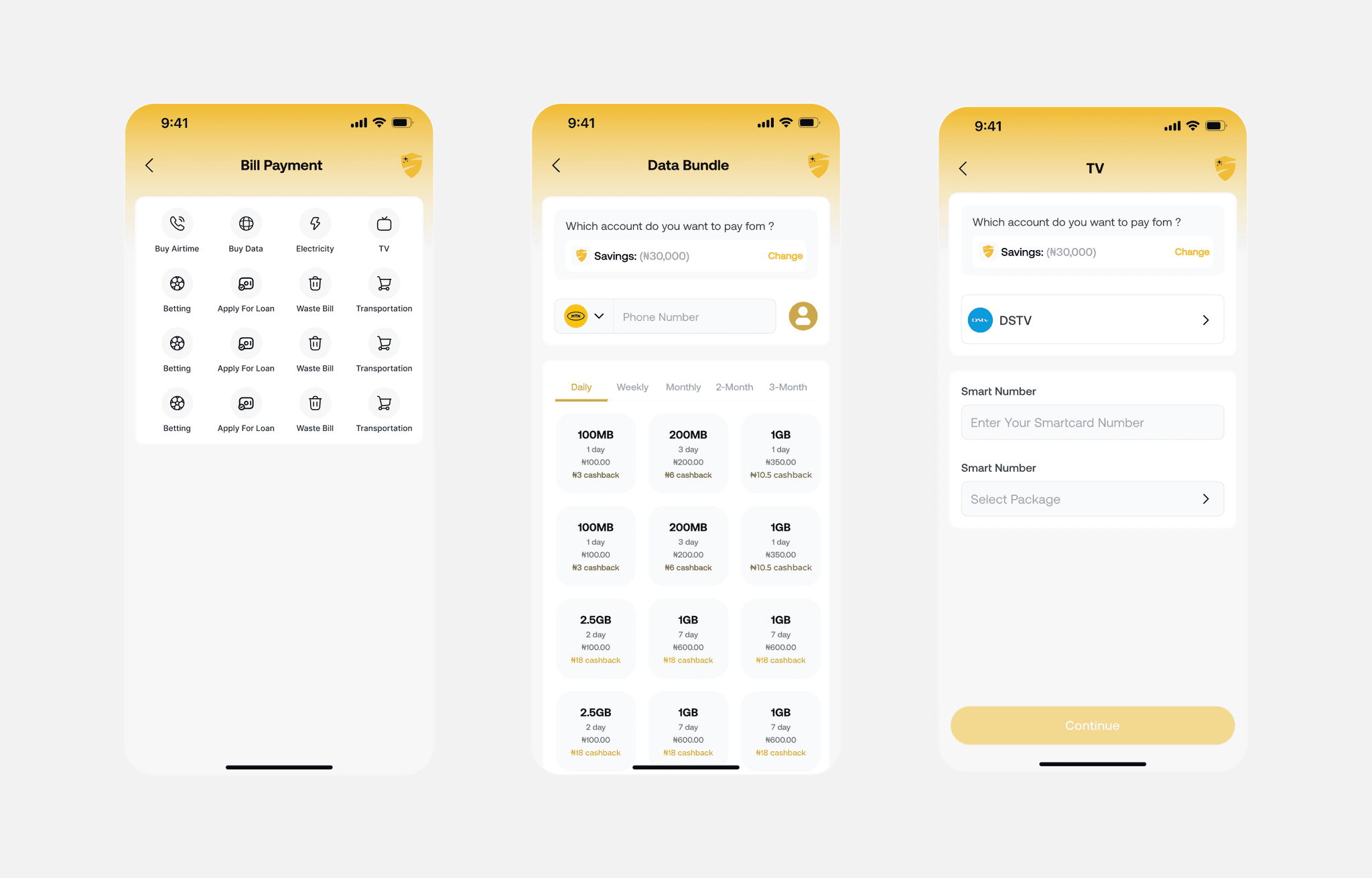

Airtime, Data, Cable Tv, Electricity, Betting and more bills

Users can handle airtime, data, cable TV, electricity, betting, and more directly in the app. The flow is designed to stay clear and quick, with real-time feedback and simple confirmation screens.

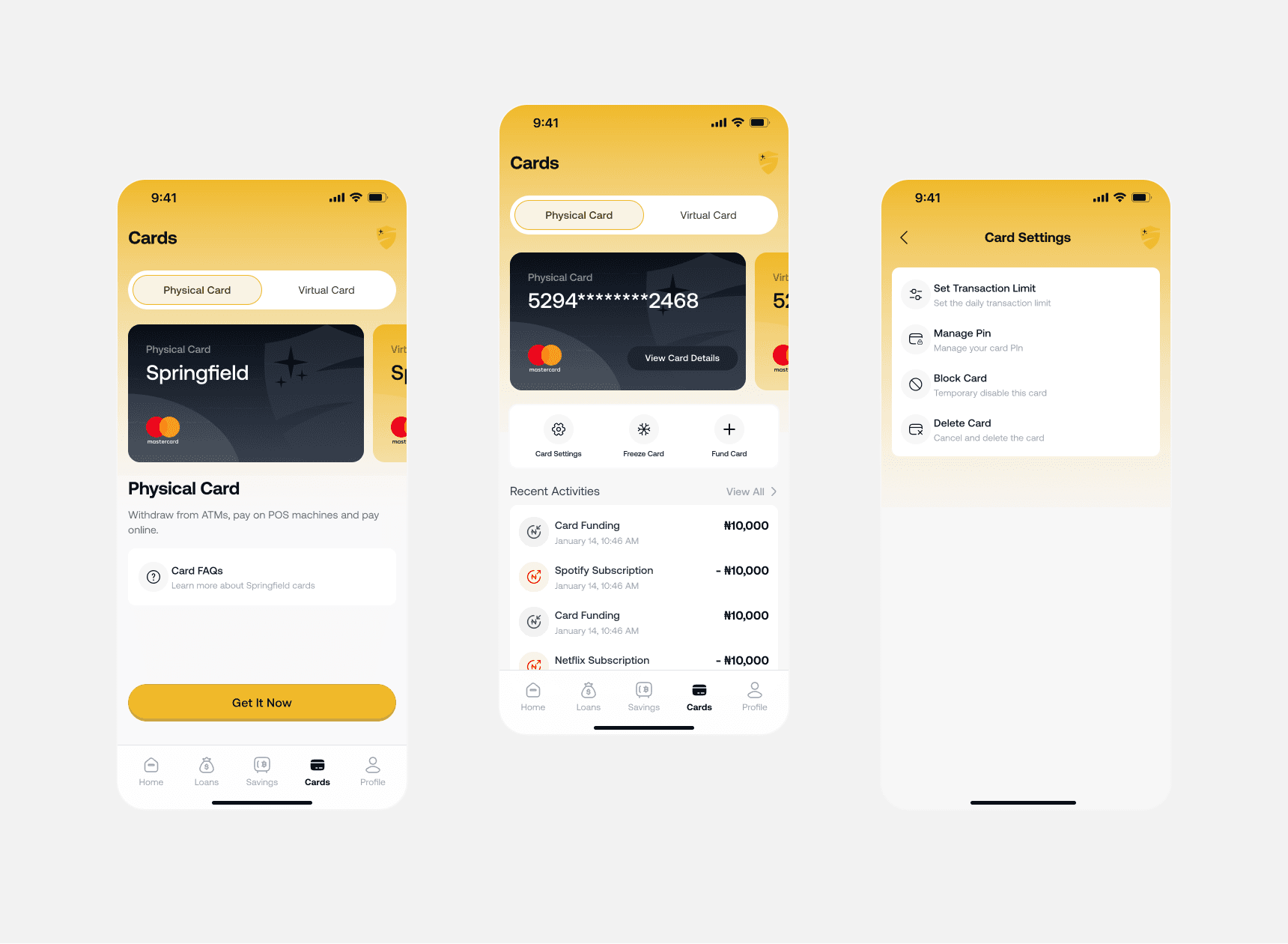

Physical and Virual Cards: Total Card Control, Right From Your Phone

Users can order a new physical card or manage their virtual cards from one simple dashboard. They can block, freeze, or change transaction limits instantly, without calling support or going to the branch. It keeps everything clear, secure, and right at their fingertips.

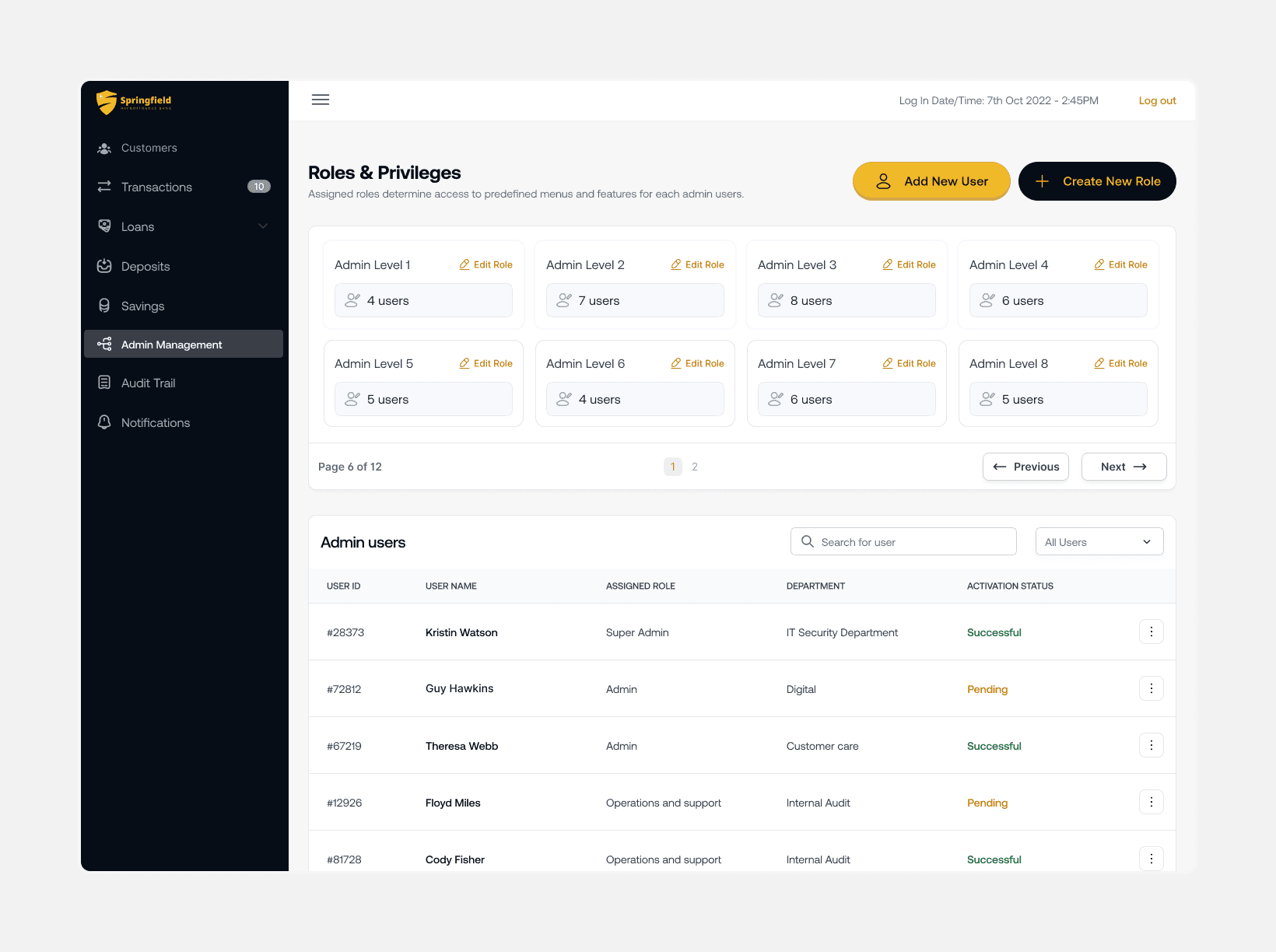

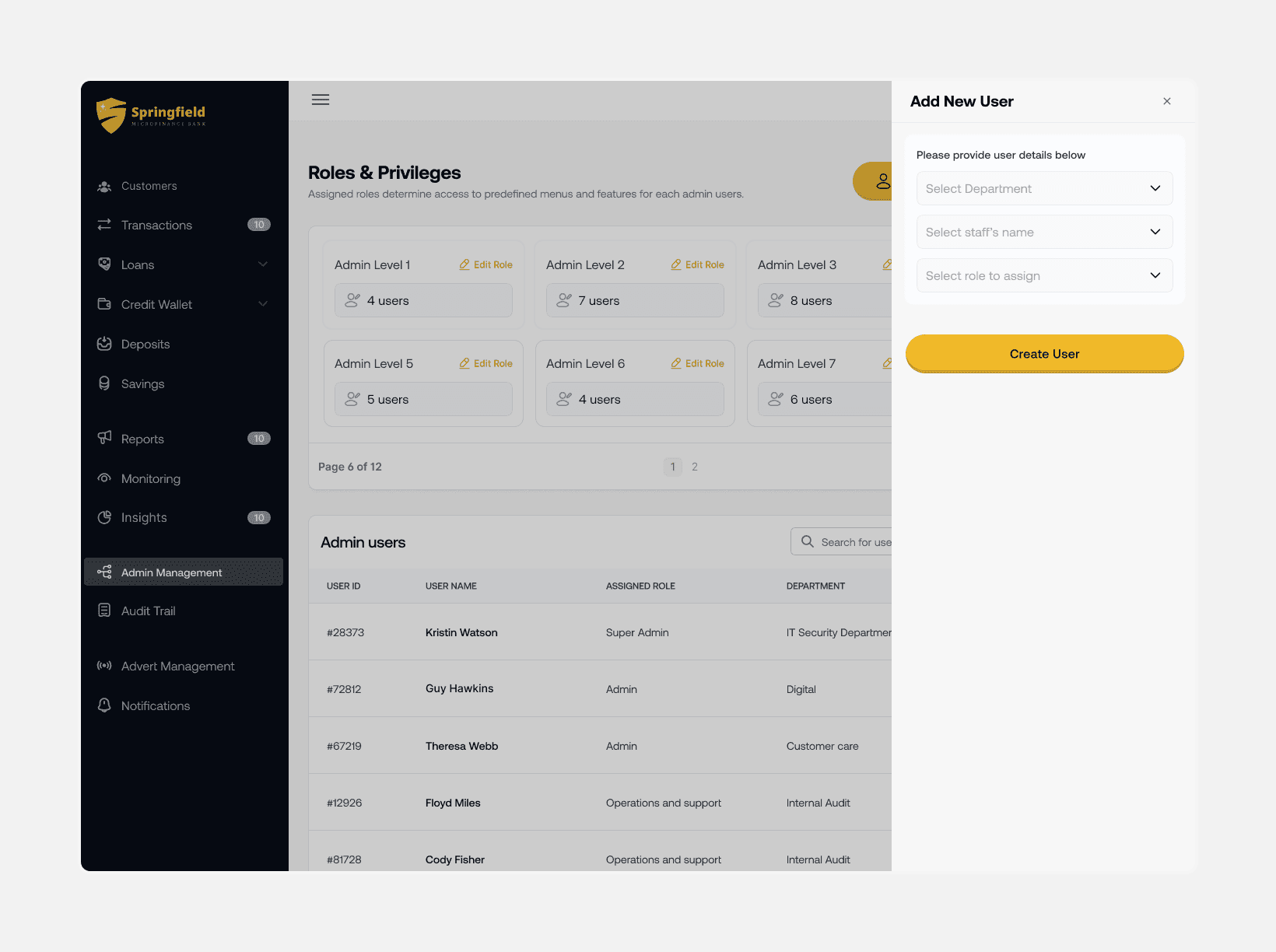

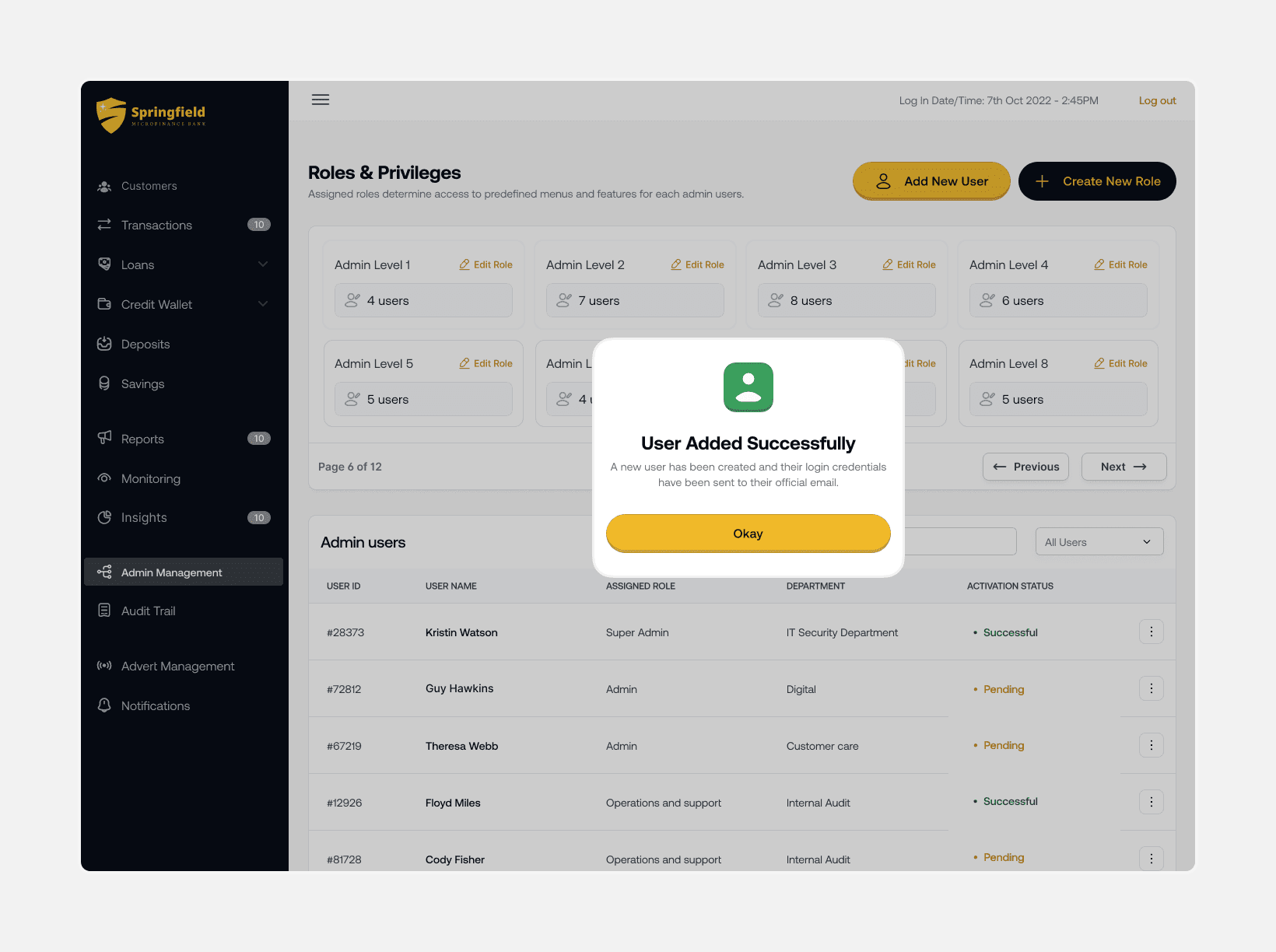

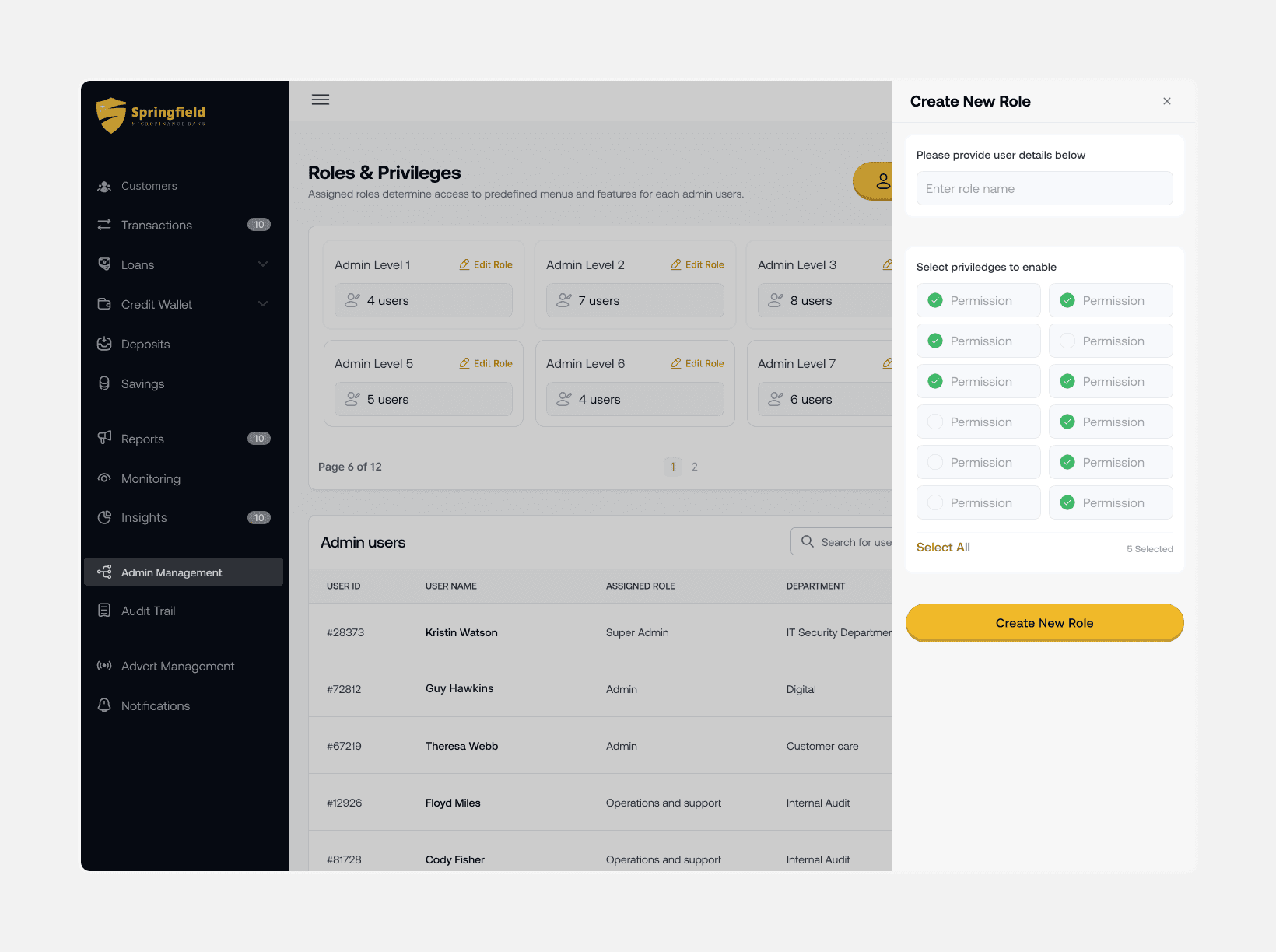

Admin Management Flow

The admin dashboard lets Springfield’s team manage roles and permissions without IT. They can see all roles, search through admin users, and update details quickly. New admins are added through a simple side panel, and roles can be edited with an easy permissions grid. Invites use secure email templates, and deletions include a confirmation step. Everything is in one place, so onboarding and updates are faster and more controlled.

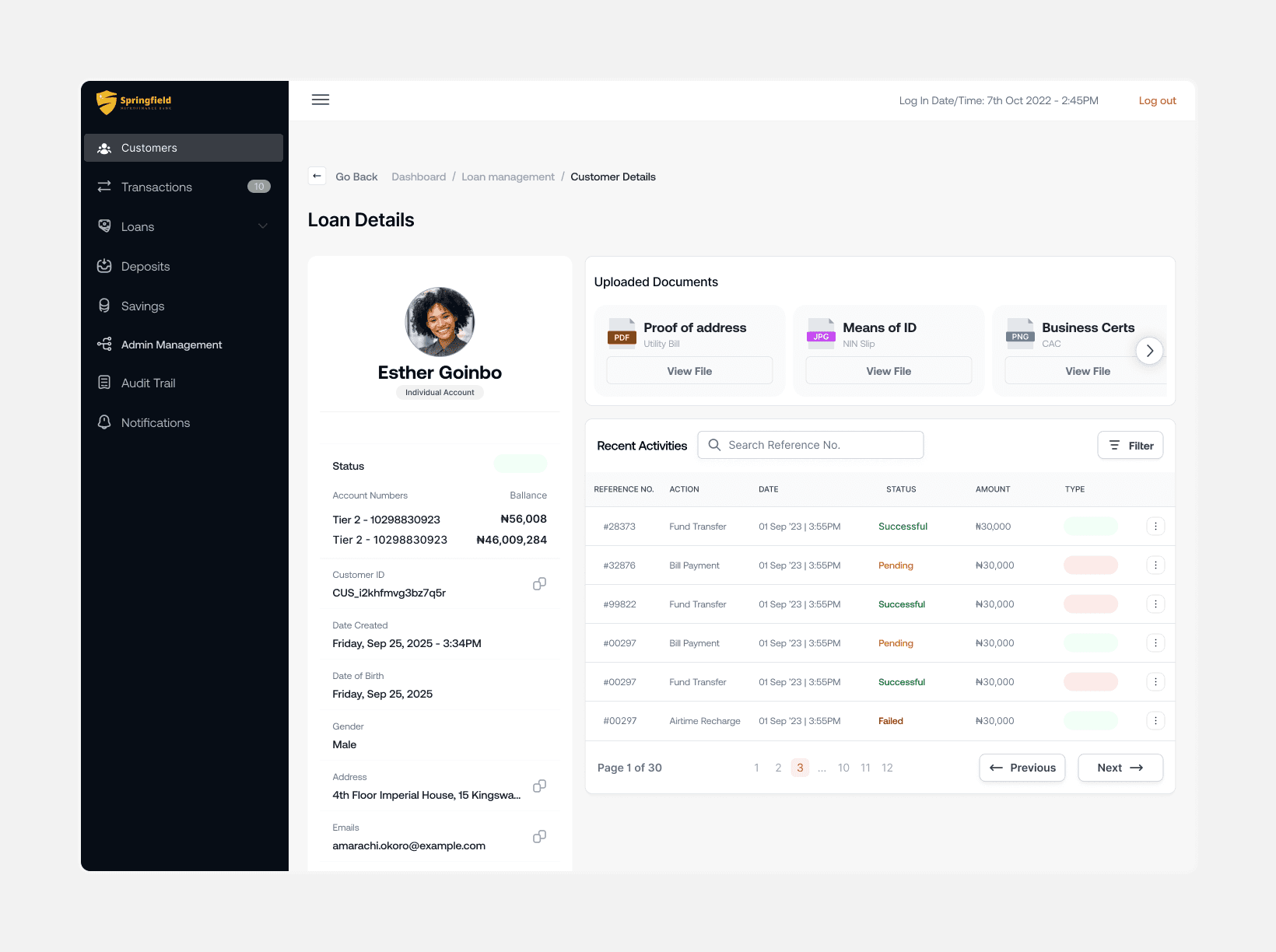

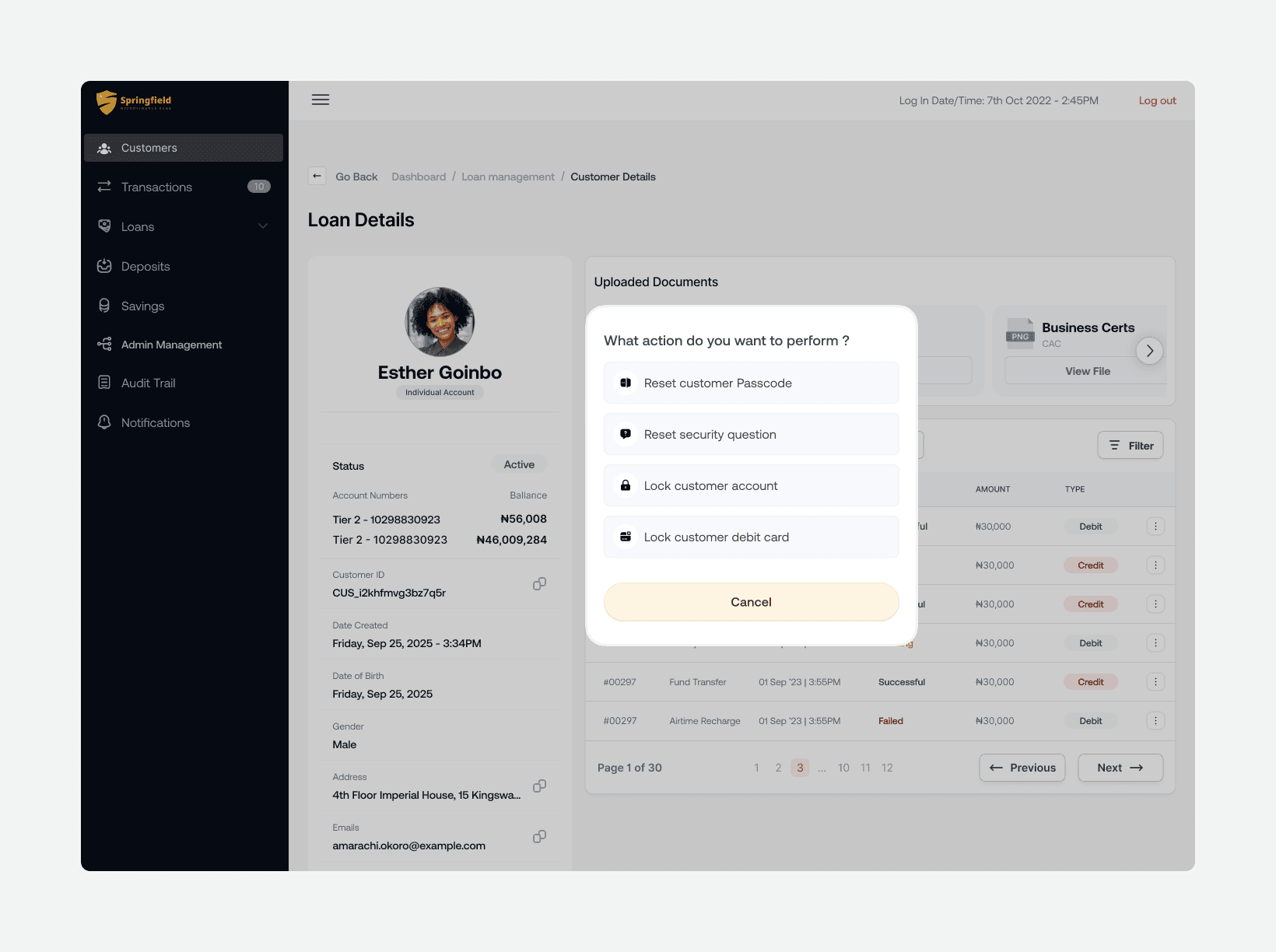

Admin: Customer Management

The customer management dashboard gives Springfield’s team a single view of each customer’s details, balances, and activity. Admins can update accounts, manage loans, and send notifications directly from the profile. This flow ensures responses are faster and the team depends less on IT.

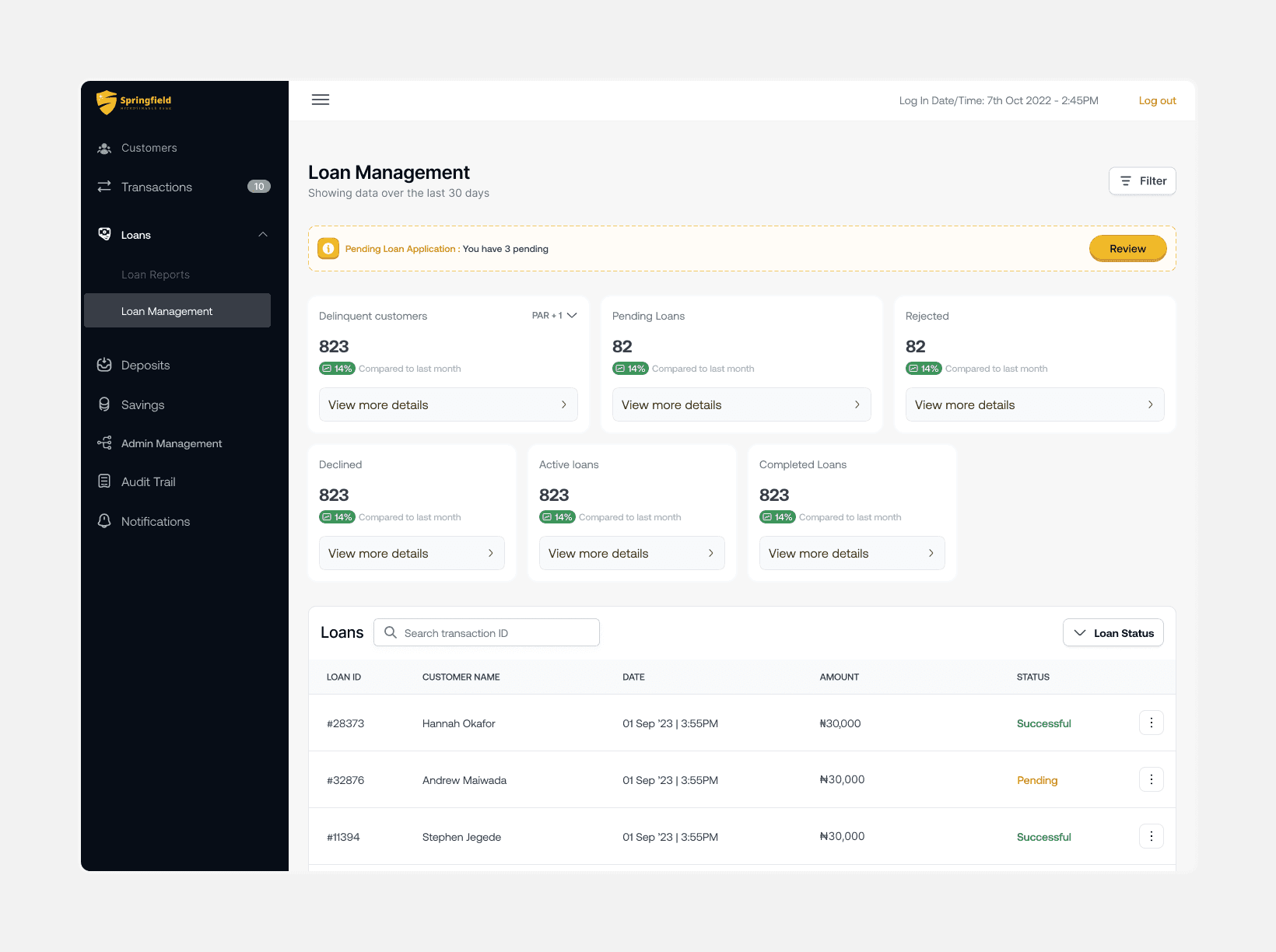

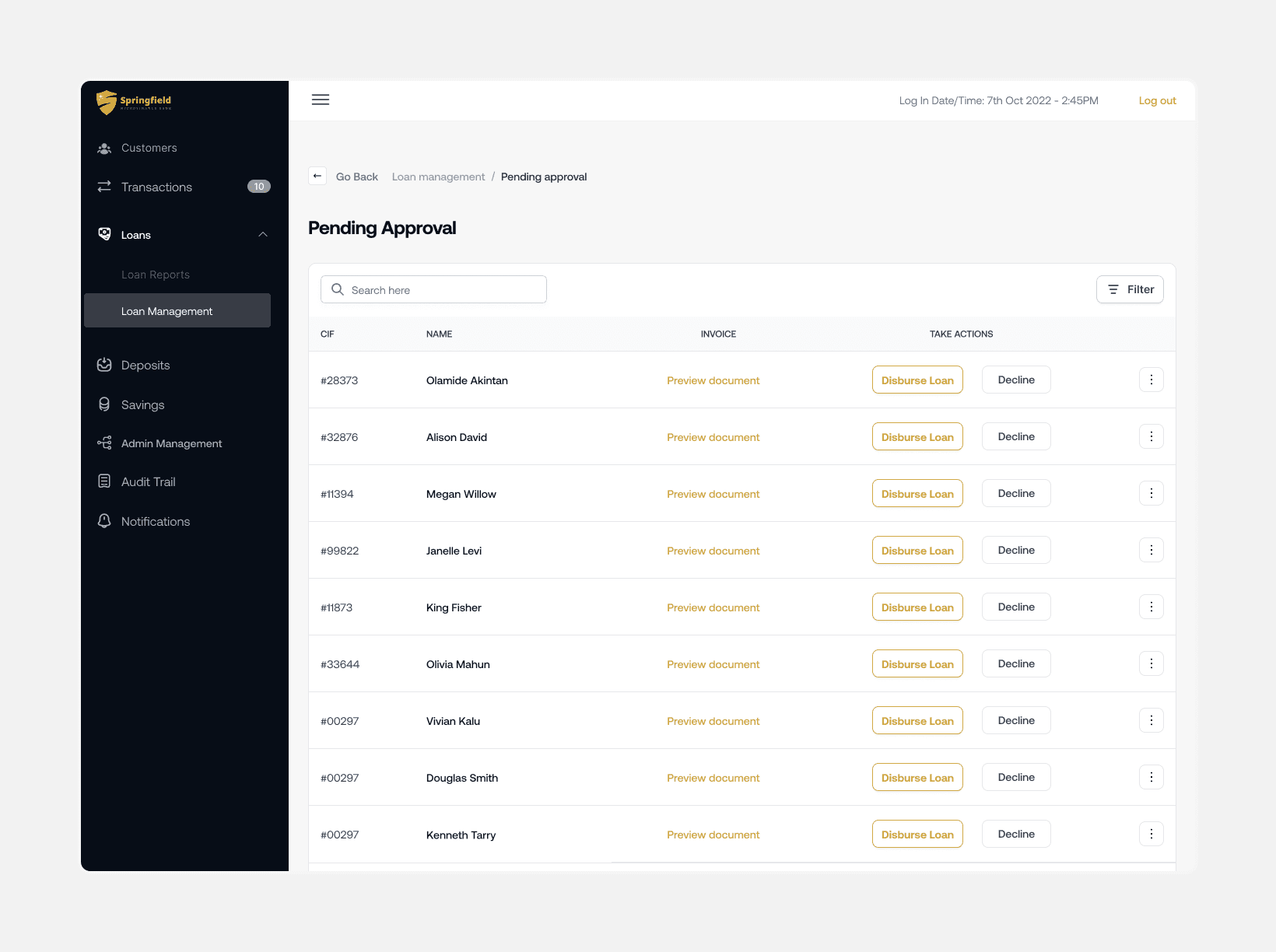

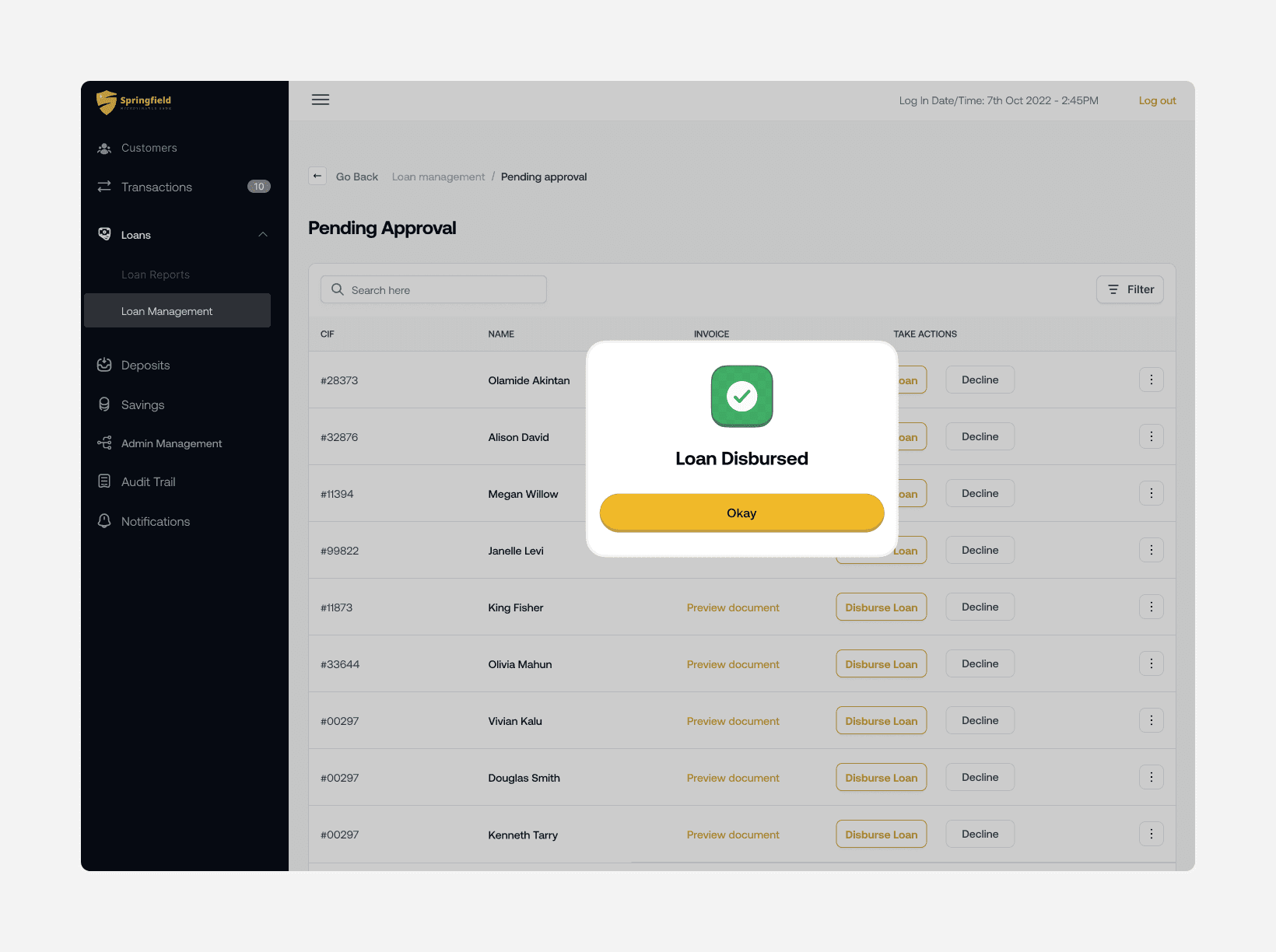

Admin: Loan Management

The dashboard shows key loan metrics and a searchable list of all loans. Admins can open any loan to see details, documents, and take actions like sending reminders or uploading compliance files. Approvals and rejections are guided with prompts to prevent errors and capture reasons for decisions. By combining high-level tracking with detailed case views and integrated actions, this flow enables fast, accurate, and compliant loan portfolio management.

Impacts and results

Customer onboarding time reduced from hours to under 10 minutes

By keeping the experience clear, fast, and trustworthy, the design achieved its main goals. Customers face less friction, the internal team works more efficiently, and Springfield can grow without lowering the quality of service. The new platform doesn’t just modernise banking for their community. It also strengthens how the bank connects with its customers.

What I learnt

Building Trust Is the Product

This project showed me that in fintech, especially in emerging markets, trust matters more than looks. Small moments like name validation and clear success screens helped users feel safe. Designing for reassurance, not just speed, became the real lesson for me and it’s something I’ll carry into every financial product I work on next.