Eldaa Bank

Finance

2025

Design

Overview

A Simple Digital Banking Experience for the DRC

Eldaa Bank is a digital-first banking platform designed to give people in the DRC a simple way to manage their money. The goal was to create an experience that feels straightforward, dependable, and accessible to everyday users. Eldaa brings key financial services into one place so people can send money, pay bills, and handle basic banking needs directly on their phones. The product was built to feel familiar even to first-time digital users, offering a practical step toward modern banking without requiring a visit to a physical branch.

The Problem

Low Access to Banking and Slow Adoption of Mobile Money

Less than 18 percent of adults in the DRC have access to formal banking. Most people still rely on cash for daily transactions, and mobile money hasn’t grown the way it has in other African countries. The challenges come from both structural and social barriers. Mobile networks are unstable, electricity is unreliable, and internet access is still limited. Many people also have low financial literacy, which makes digital banking feel confusing or risky. Even when apps are available, mistrust is a major issue. People worry about losing money or making mistakes they can’t fix.

The Goal

Building Eldaa Around Real User Needs

To build a banking experience that works for people in the DRC, Eldaa was designed with a few clear goals.

Make onboarding easy: Many people don’t have formal ID or documents, so account creation had to work with just a phone number and SMS.

Keep the app simple: The interface uses large buttons, clear navigation, and layouts that feel easy for anyone to understand, even with limited digital experience.

Access key details offline: Because internet and electricity are unreliable, essential features like checking balances and viewing transaction history needed to work without a live connection.

Teach users as they bank: Eldaa includes tutorials, videos, and guides in local languages to help people learn the basics of digital finance.

Support small payments: Since daily life relies on micro-transactions, the app keeps fees low and allows very small transfers and bill payments.

Build trust: Security features like PINs, biometrics, and encryption are built in, along with in-app chat for immediate help and reassurance.

The Research

Mapping the Full Eldaa Experience

To give the team a clear picture of what we were building, Eldaa Bank’s entire user flow was mapped out in FigJam. It covered everything from onboarding to transfers, savings, and support. Having it all in one place made it easy to spot friction early, understand how users move through the app, and make sure every journey felt simple and inclusive.

The Process

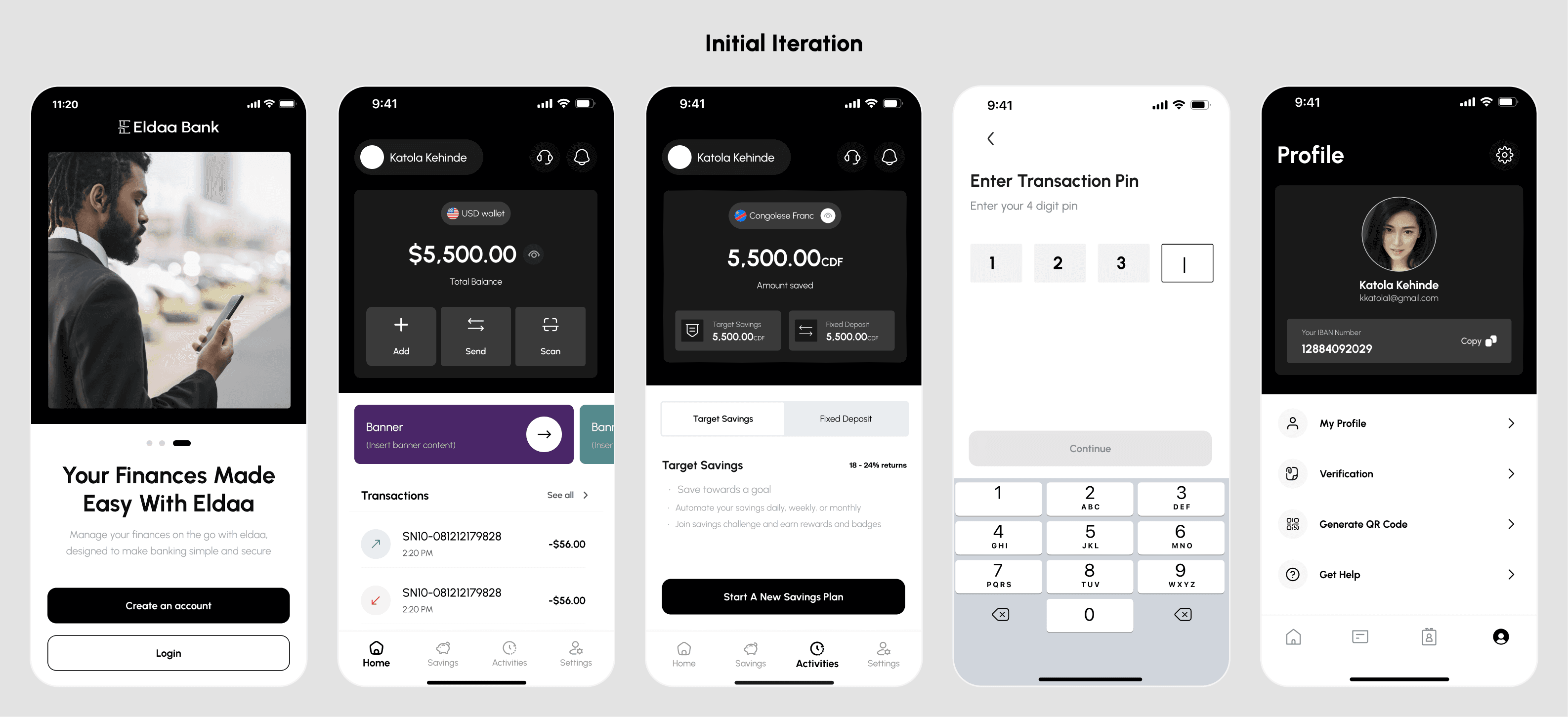

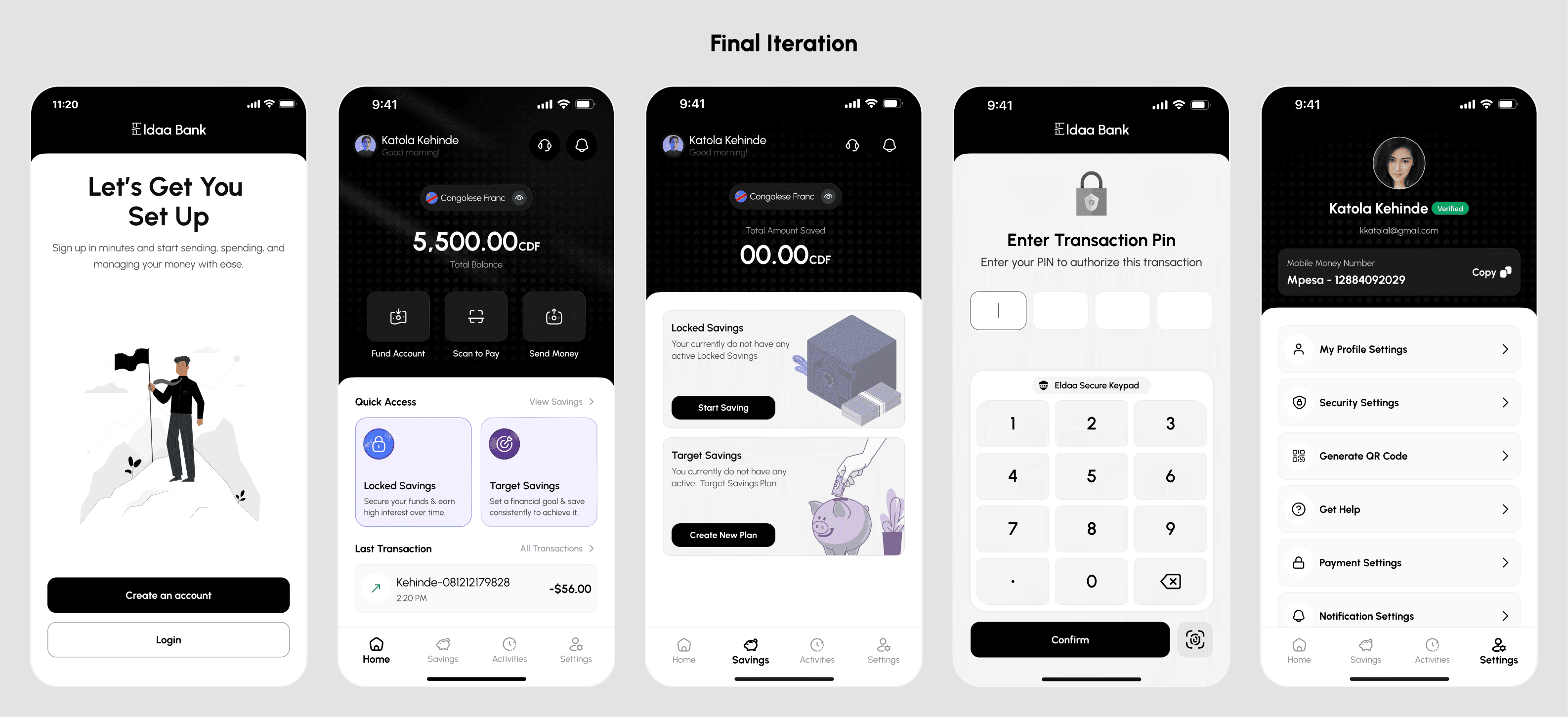

Designing Eldaa in Iterations

The first version of Eldaa already covered the core flows, but the team wanted an experience that felt calmer, clearer, and more visually consistent. We reviewed the early designs, identified areas that looked cluttered or overwhelming, and then refined the layouts, spacing, and visual hierarchy. This second iteration focused on making the interface feel more modern and more comfortable for first-time digital banking users. The goal was the same. Keep every screen functional, familiar, and easy to trust.

Design Solution

A Clear and Accessible Banking Experience

Eldaa Bank was designed to be simple and easy to trust. Users can sign up with just their phone number, and the interface stays clear and friendly for first-time digital users. The app also works offline for basic tasks like checking balances, and it includes financial literacy guides in local languages to help users learn. It supports low-cost micro-transactions, international transfers, and QR payments for businesses. Security features like PINs, biometrics, and encryption help users feel safe while banking on their phones.

Onboarding: A Simple, Guided Start for New Users

Eldaa’s onboarding was designed to feel friendly and easy to follow, especially for people using digital banking for the first time. Each step is guided, with clear visuals, simple inputs, and progress indicators that show where the user is in the process. Verification was also structured to feel less intimidating. Phone number entry, SMS codes, personal details, and face verification happen one step at a time so nothing feels confusing or rushed.

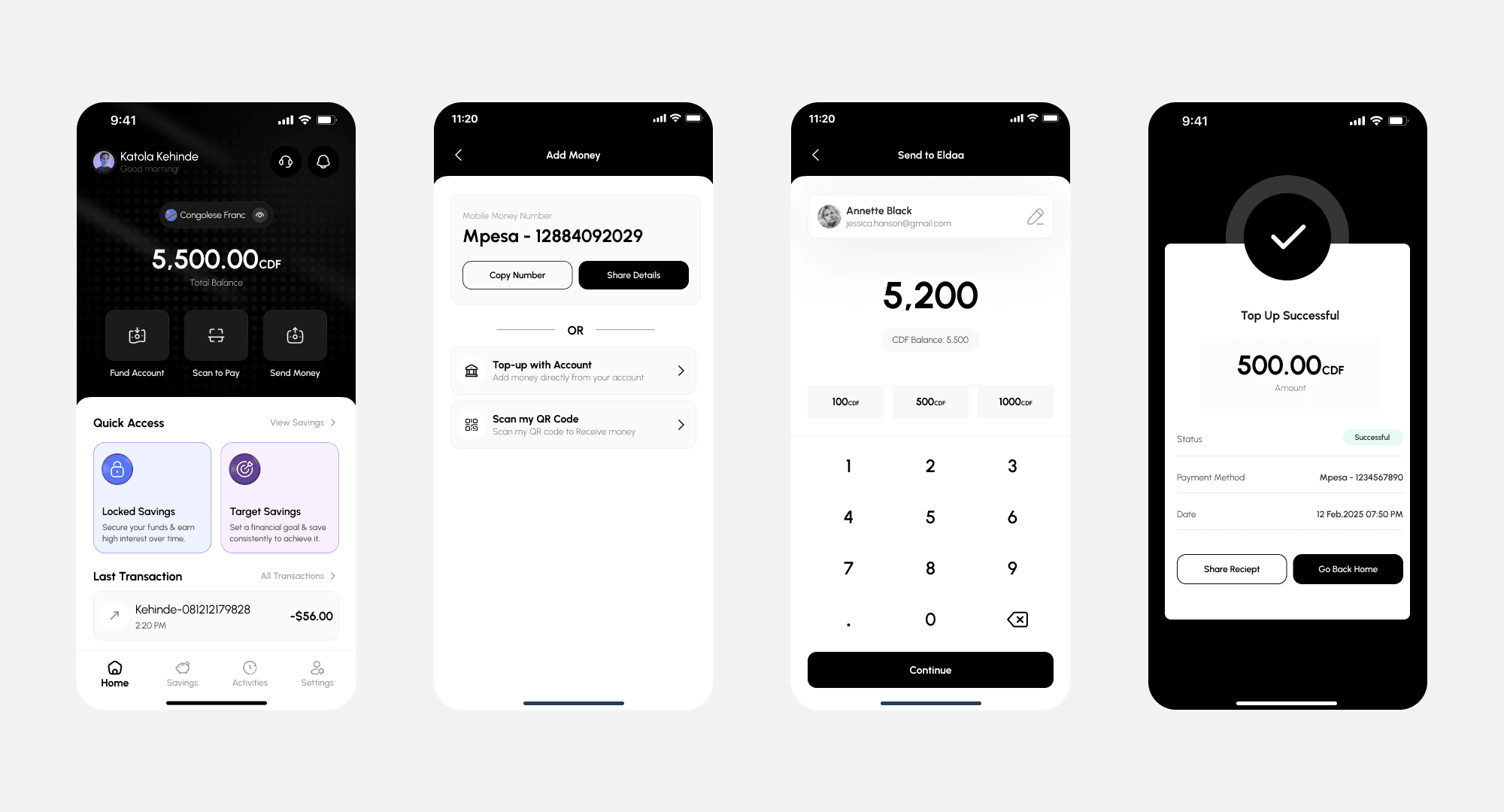

Add Money on Eldaa

Users can fund their Eldaa accounts through several channels. They can link mobile wallets like Orange Money or M-Pesa, or connect a bank account to top up. Every new payment method goes through a quick code check and transaction PIN confirmation for security. The app also gives clear, real-time feedback so users always know whether a link was successful or needs to be retried.

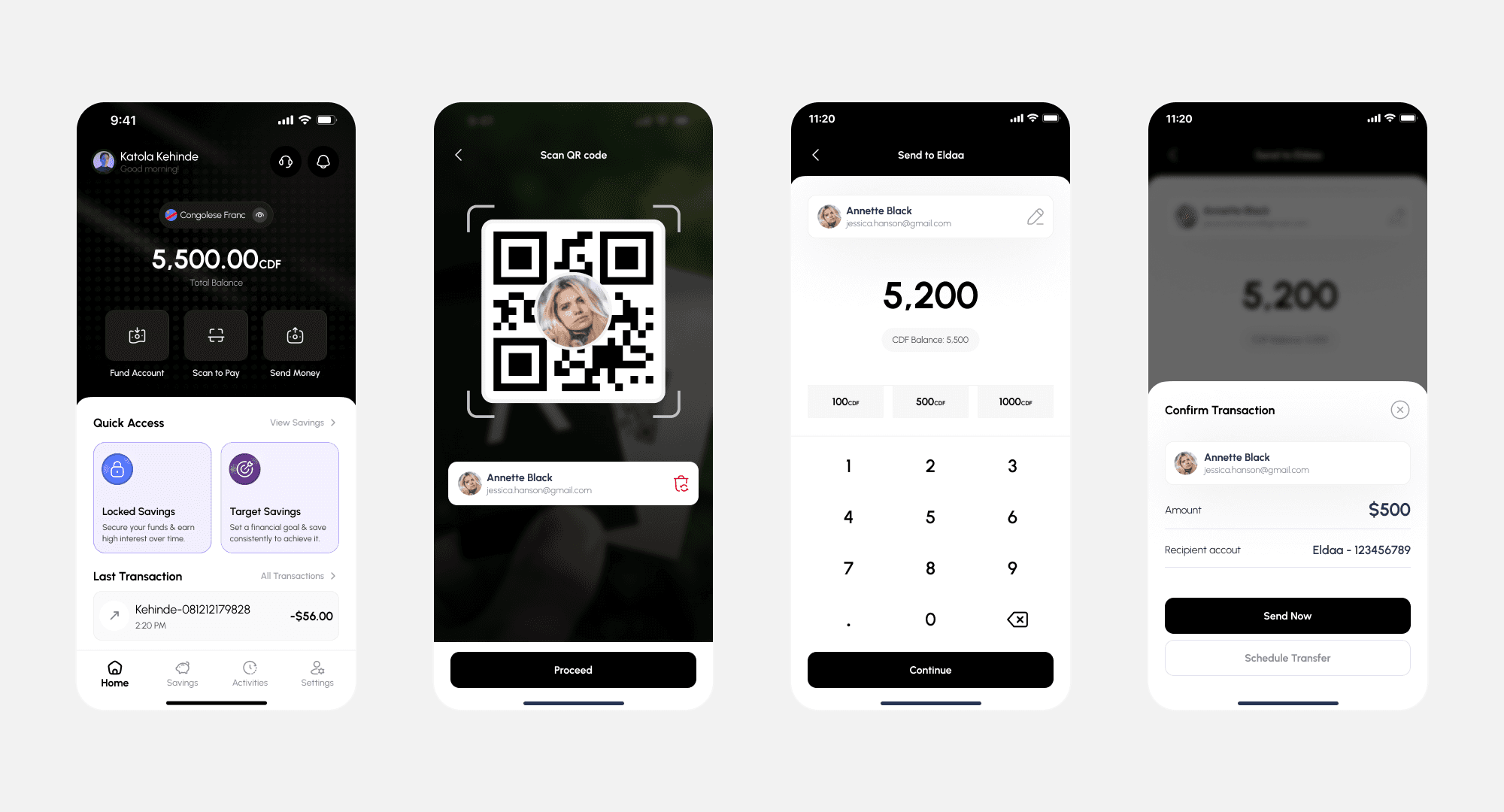

Send Money: From Eldaa to Everywhere

Eldaa makes sending money simple, whether it’s to another Eldaa user, local banks, or to mobile money providers. Users can pick recipients from recent activity, saved beneficiaries, or their phone contacts to avoid typing errors. The input screen stays clean, with quick amount shortcuts and smart fields that only show what’s needed. Transfers can be scheduled, fees are shown upfront, and every transaction ends with a clear confirmation screen for reassurance.

Scan to Pay

Scan-to-Pay was built for quick daily transactions. Users can open the camera from the home screen and scan any merchant or personal QR code. When the code is valid, the recipient’s details fill in automatically so payment can continue right away. After this, the flow continues just like a normal transfer with amount entry, confirmation, and a final success screen.

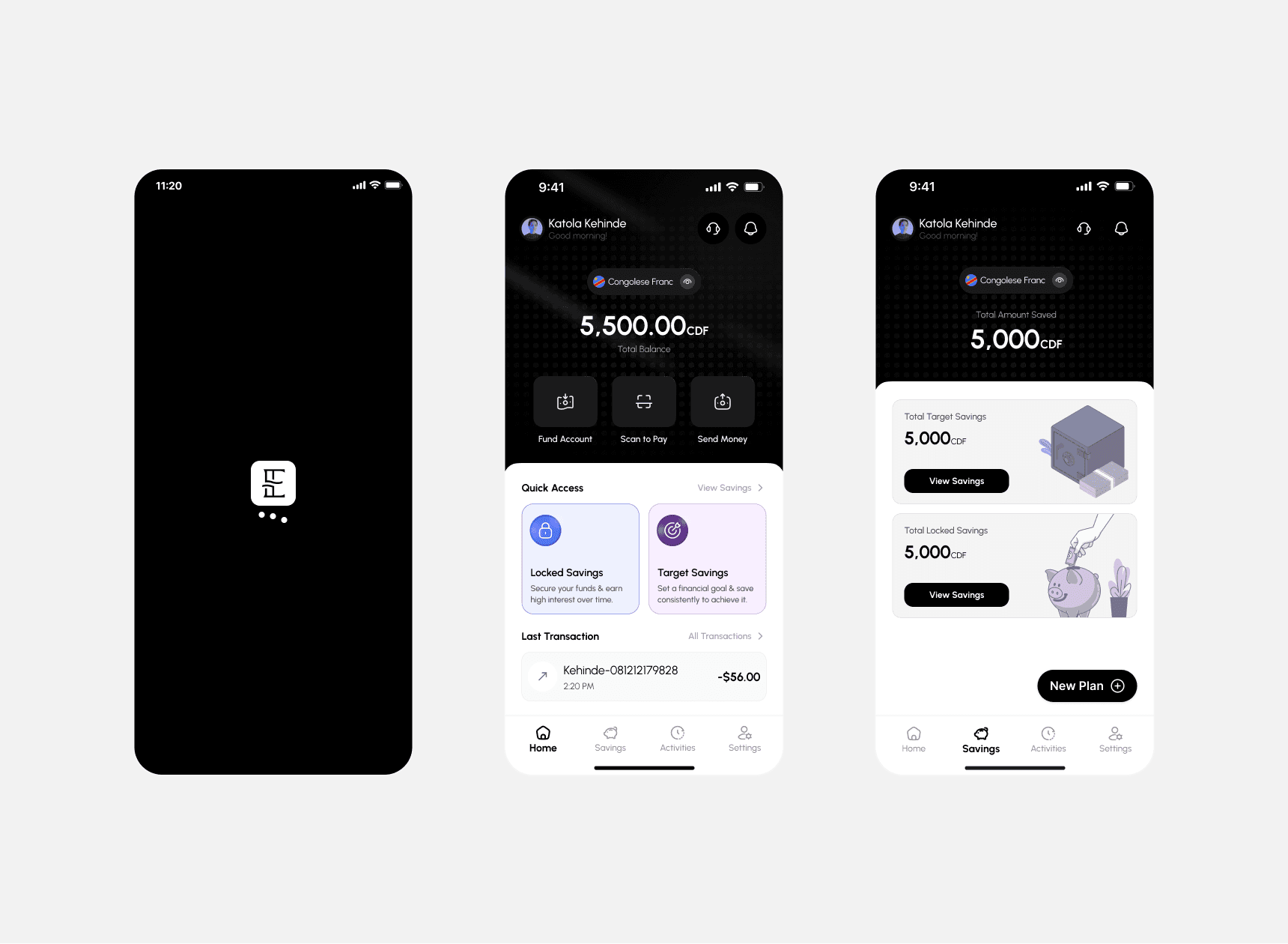

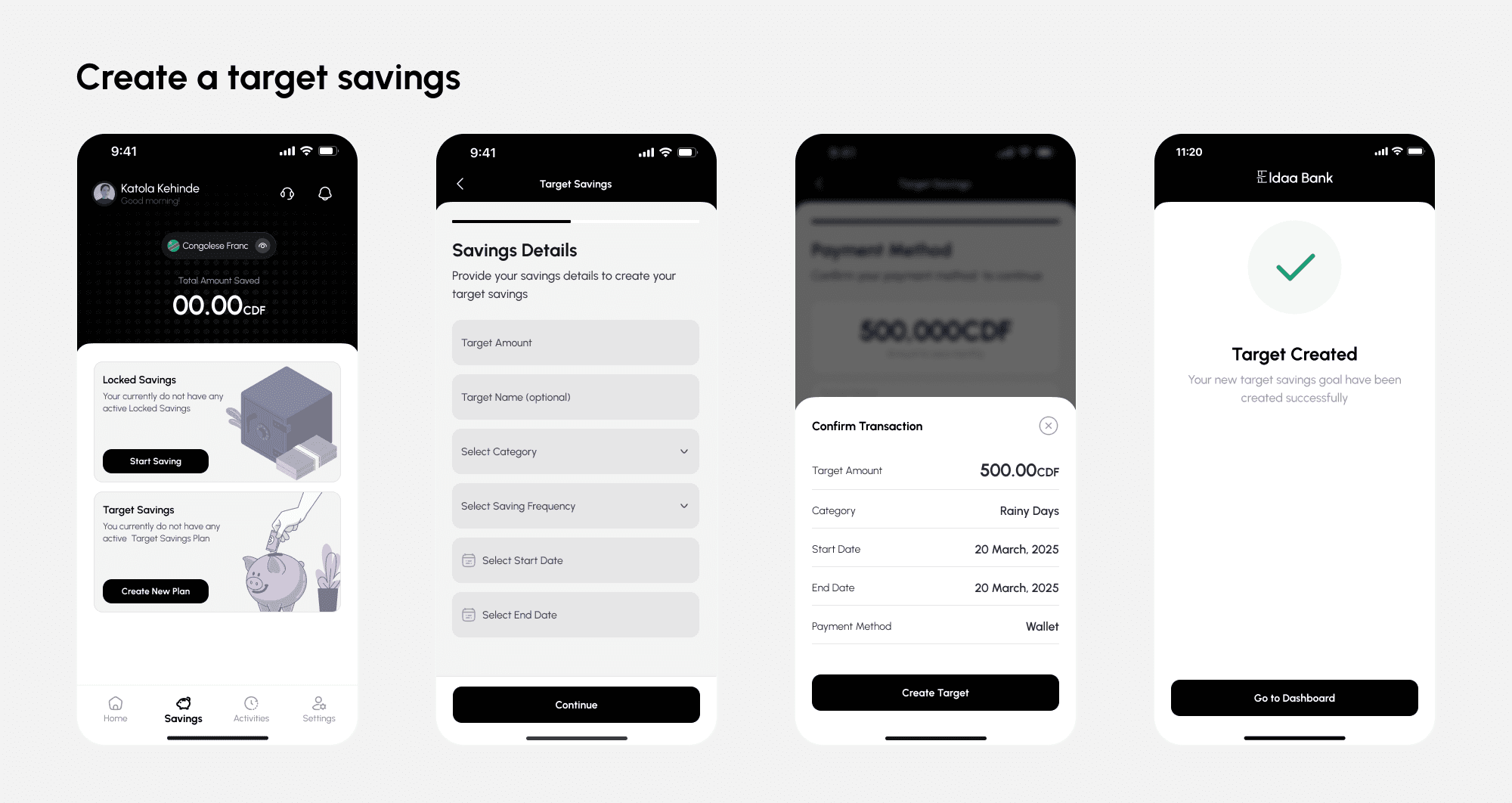

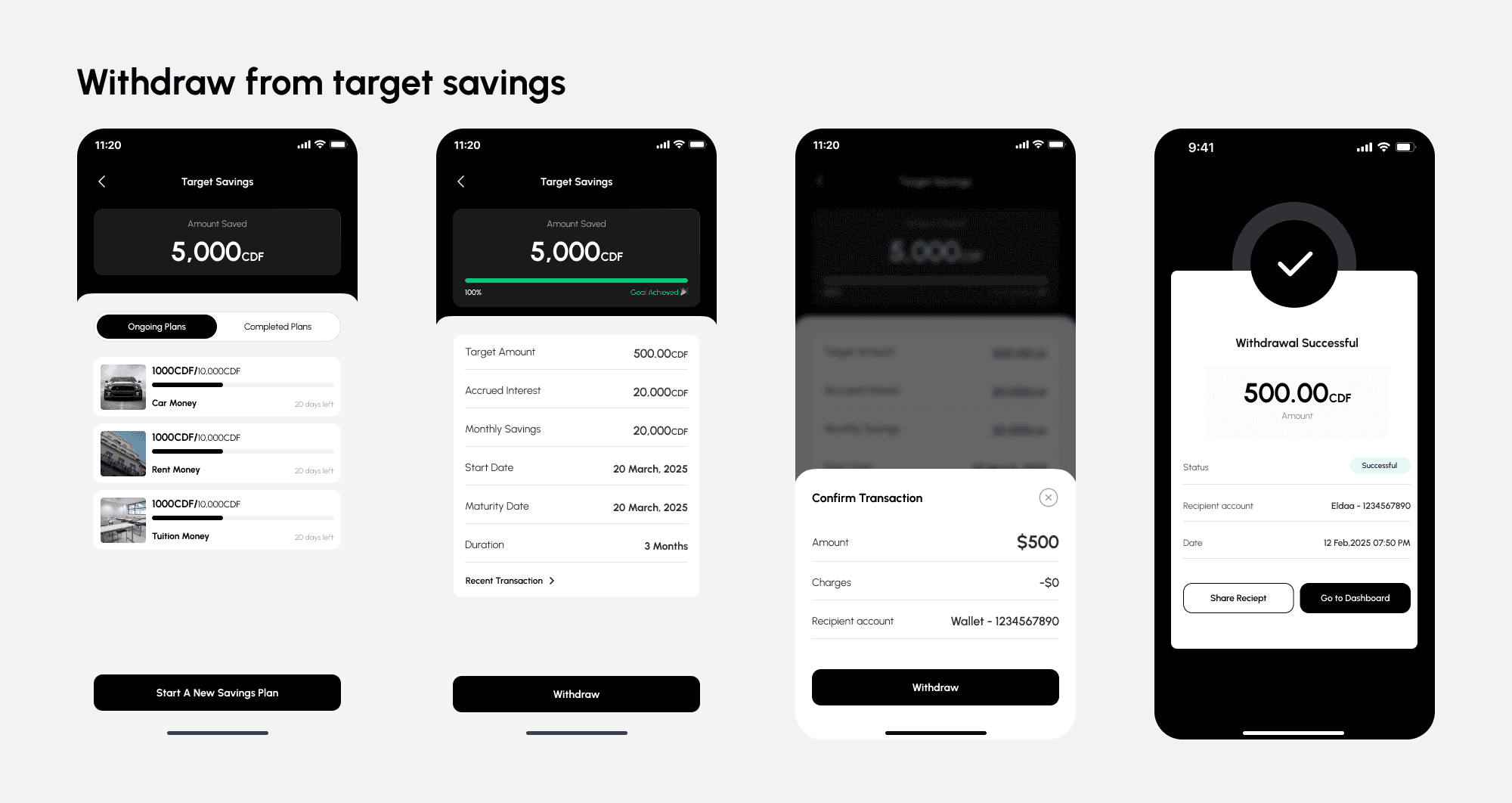

Target Savings

These are goal-based plans that help users stay consistent. Setting one up is easy. Users name their goal, pick a category like rent or tuition, and choose how much they want to save and how often. A built-in calendar lets them select their start and end dates visually, which reduces mistakes. Before activating the plan, they see a quick summary of the amount, frequency, and source wallet. Once everything is confirmed, a clear “Target Created” screen wraps it up and makes the plan feel official.

Fixed Deposit

Fixed deposits are for users who want to lock in money and earn more over time. They can choose preset terms like 3, 6, or 12 months, and a preview card shows the amount, interest rate, and what they’ll get at maturity. After confirming, the flow ends with the same clear success screen used across the app, which keeps the experience familiar and reassuring.

Waitlist and Coming Soon

Before Eldaa Bank launched, I designed a waitlist page to introduce the brand, build anticipation, and earn early trust. The goal was to get sign-ups while giving people a clear sense of what Eldaa offers and why it’s different.

What I learnt

Optimizing for Low-Bandwidth Realities

Designing Eldaa bank meant constantly weighing reliability against functionality. We had to ensure users could access essential features even with poor network availability, prioritizing offline capabilities and lightweight interactions without compromising security or usability.