Accionmonie

Finance

2023 - 2025

Lead Product Designer

Overview

AccionMFB presents Accionmonie

Accion Microfinance Bank is one of Nigeria’s leading financial institutions focused on promoting financial inclusion for low- and middle-income earners. Backed by global investors like Citi, IFC, and Ecobank, Accion provides a wide range of financial services including loans, savings, and digital banking solutions. Their mission is to empower micro-entrepreneurs and small businesses through accessible, reliable financial products.

The Problem

Redesigning AccionMonie: A Better Banking Experience

Accion Microfinance Bank wanted to improve how their mobile banking app served everyday Nigerians.The initial AccionMonie mobile app faced challenges with a less secure onboarding process and limited functionality, which led to a poor user experience. The app struggled with low engagement, difficulty in accessing key features like loans and payments, and didn’t inspire much trust. Many customers still preferred visiting a physical branch, even for simple tasks like checking their balance.

The Goal

Acciomoine's over arching goals

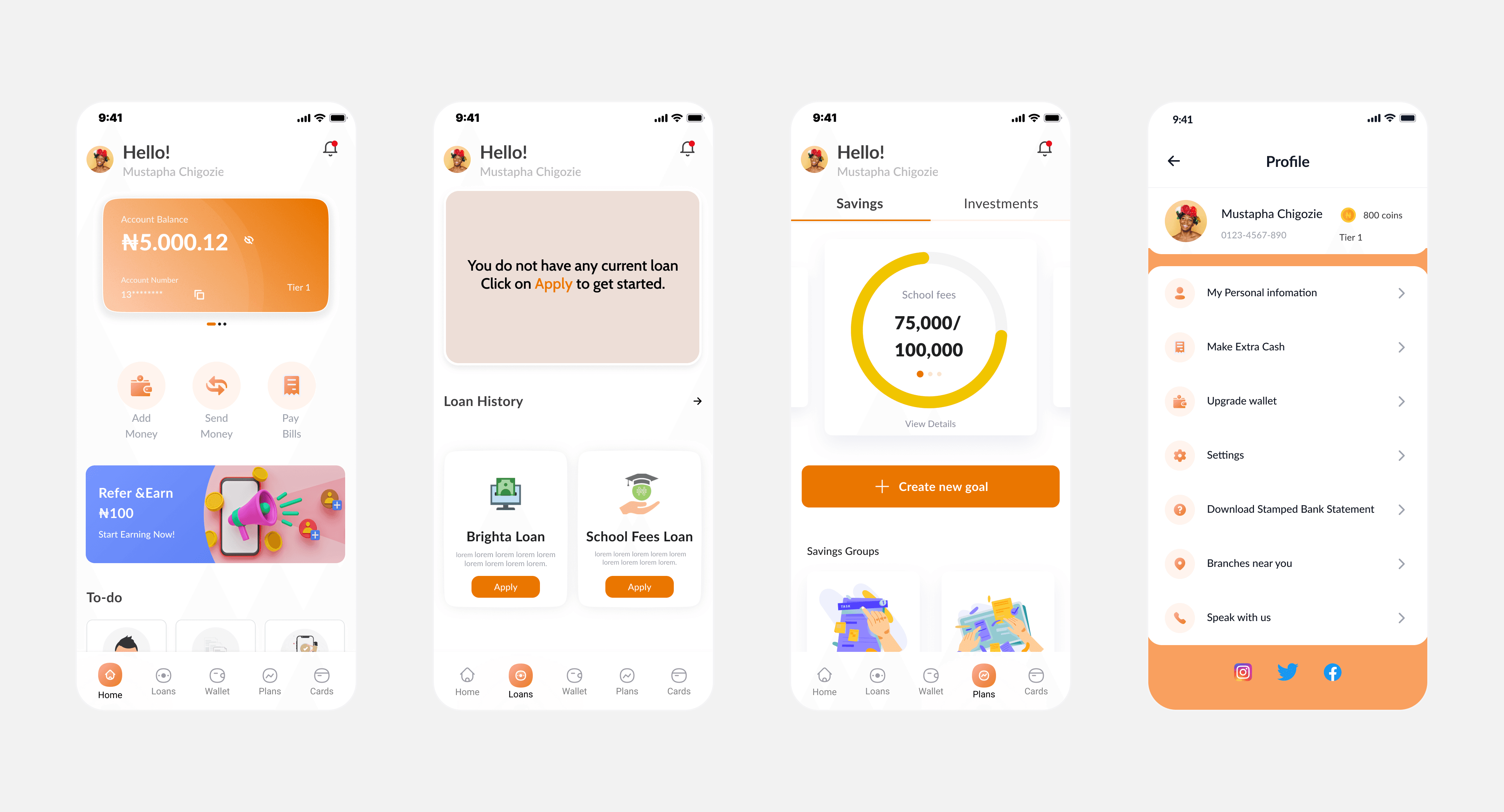

Acciomoine's was built as an all-in-one financial platform designed to meet users where they are:

One-Stop Payment Platform: Support for intra and interbank payments, card payments, QR payments, and bill payments, serving a diverse range of customers.

One-Stop Loans Platform: A hub for accessing on-demand loan products digitally, such as Buy Now Pay Later, Solar Loans, School Fees Loans, and invoice financing.

One-Stop Savings Platform: A range of savings products, including target/tailored savings, motivated savings, and locked savings.

Digital Financial Literacy: Provision of digital financial education and opportunities to customers, enhancing their financial literacy and decision-making abilities.

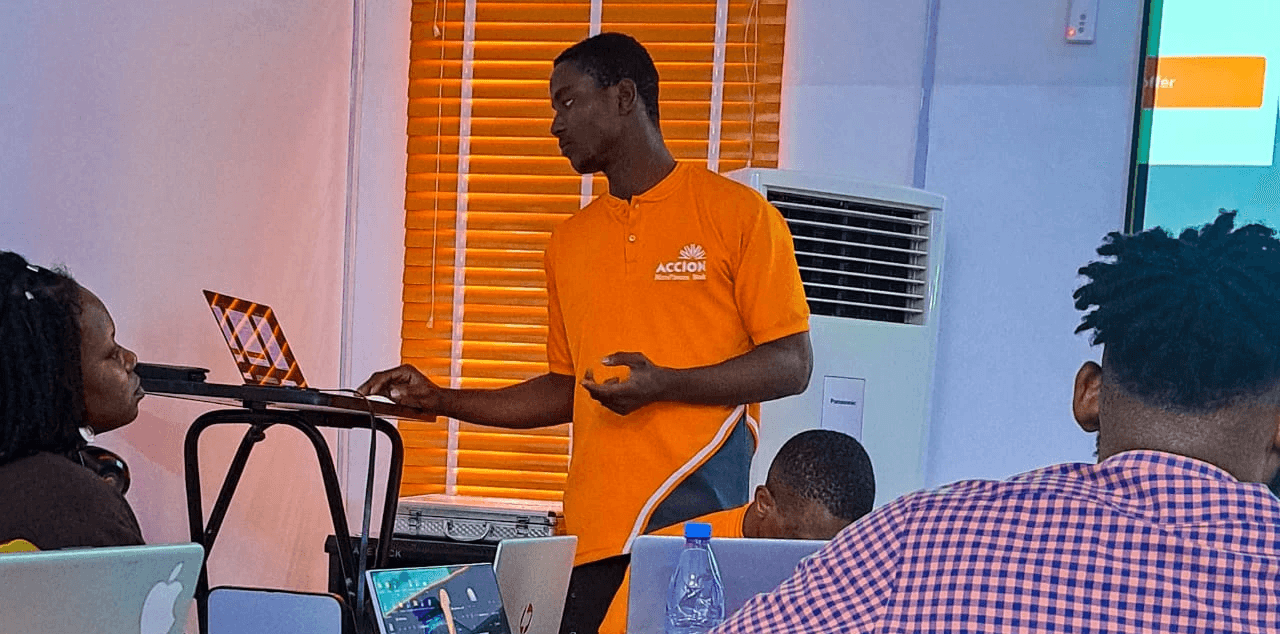

Design Solution

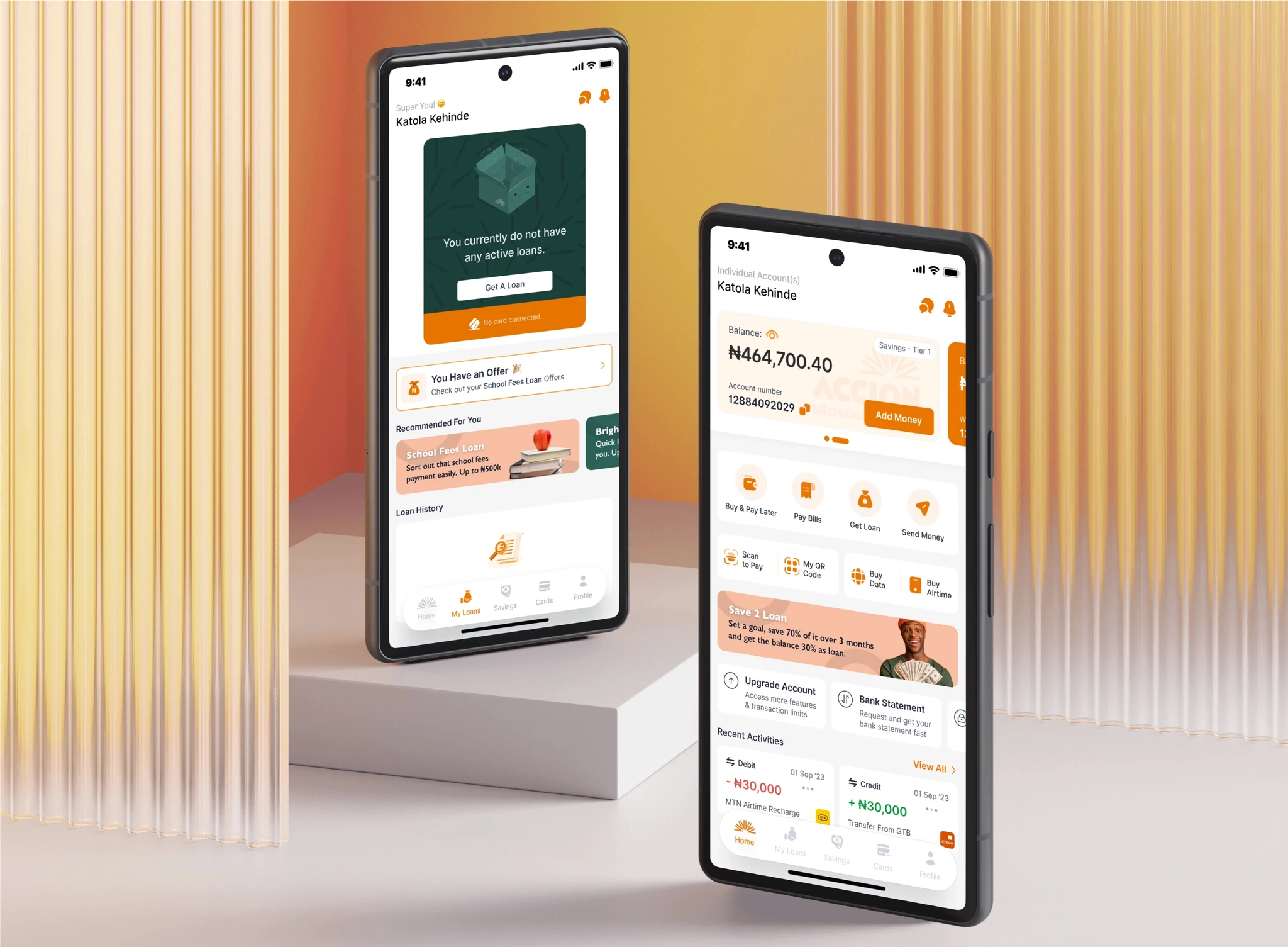

The New AccionMonie Experience

Working closely with the internal product and engineering teams, I led the full redesign of the mobile experience. We restructured the navigation, introduced guided loan flows, and added feedback mechanisms that helped users feel more in control of their actions. The app was rebuilt to feel faster, simpler, and more transparent, especially for users who were less familiar with digital banking tools

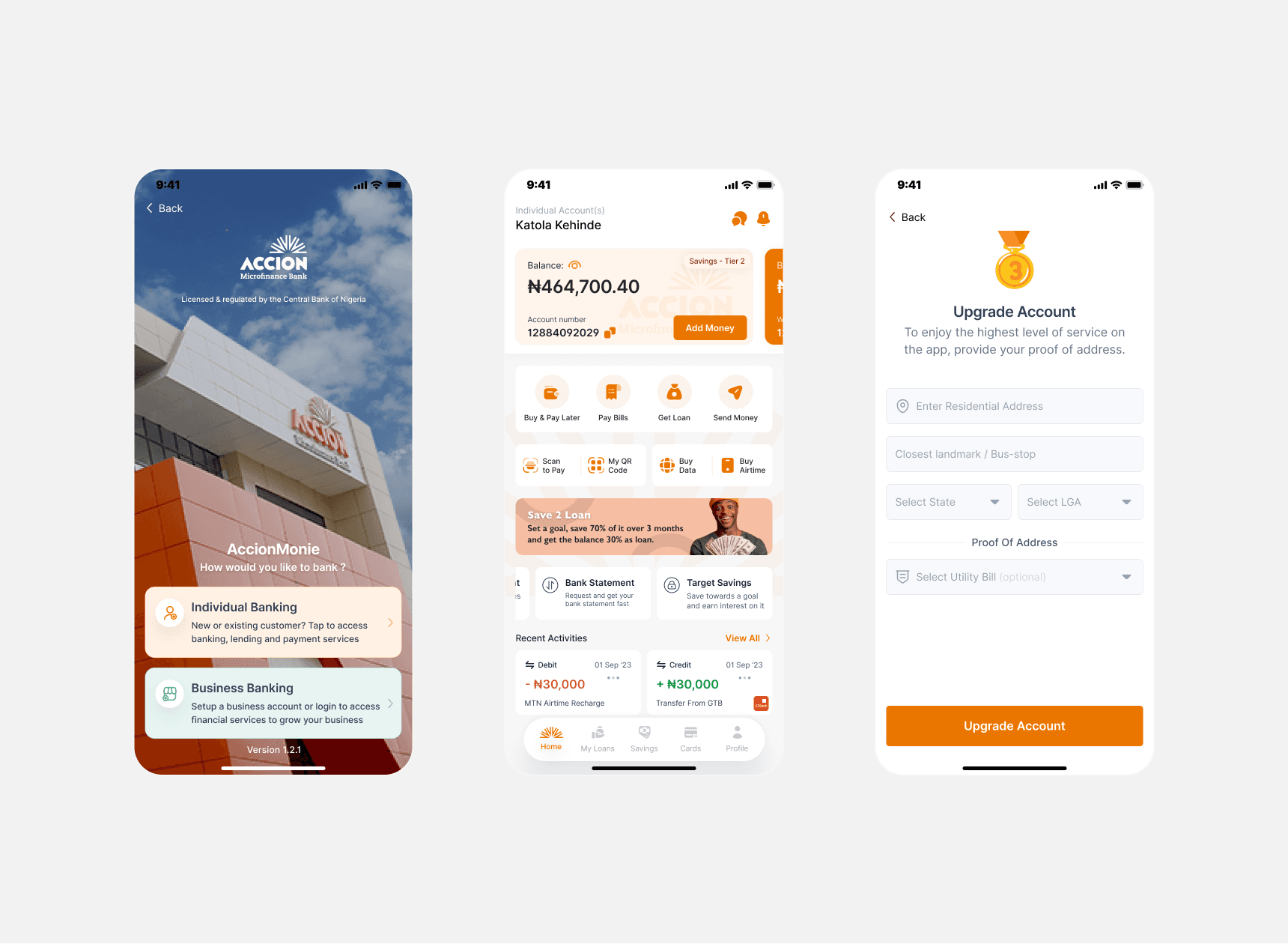

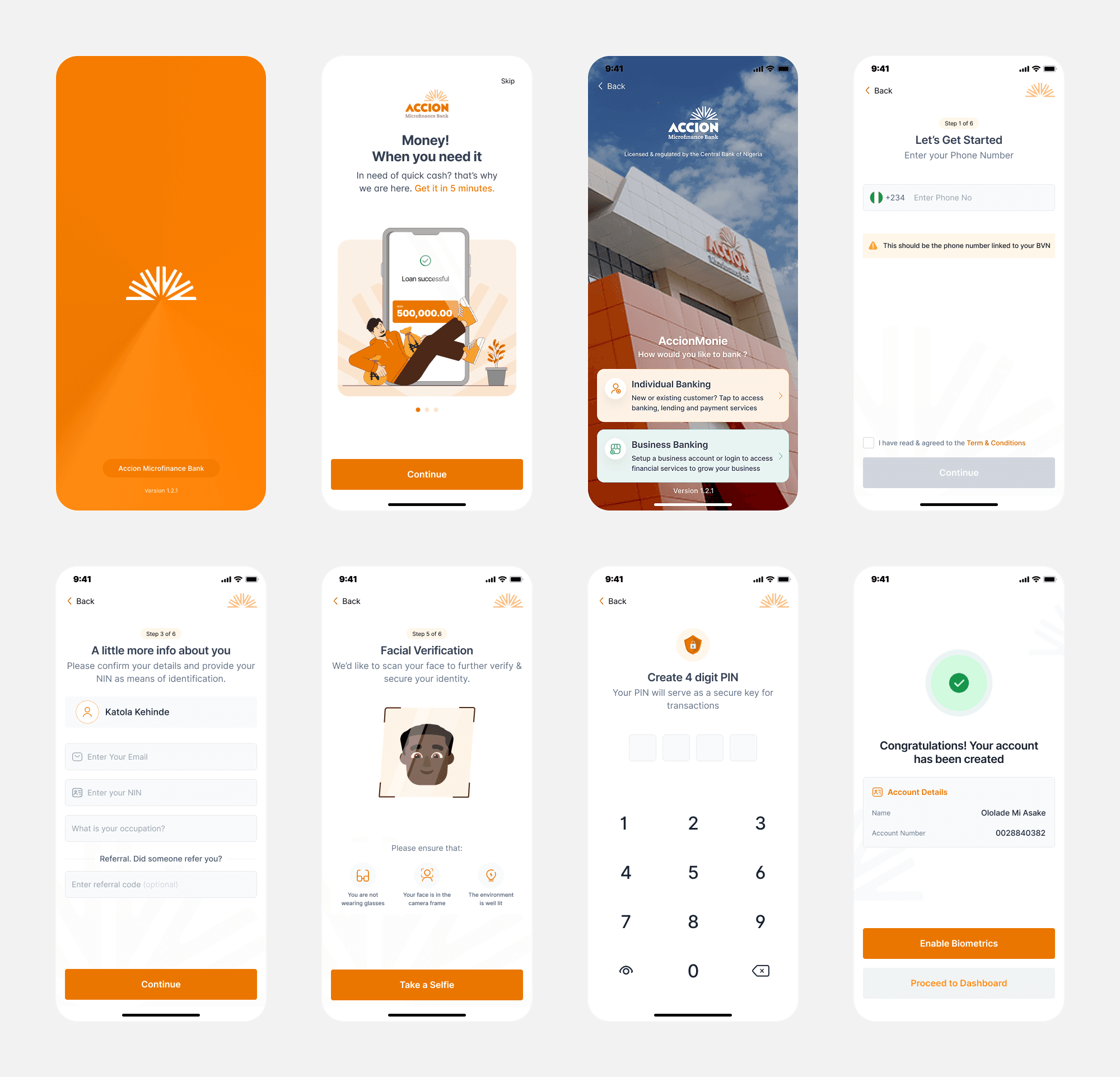

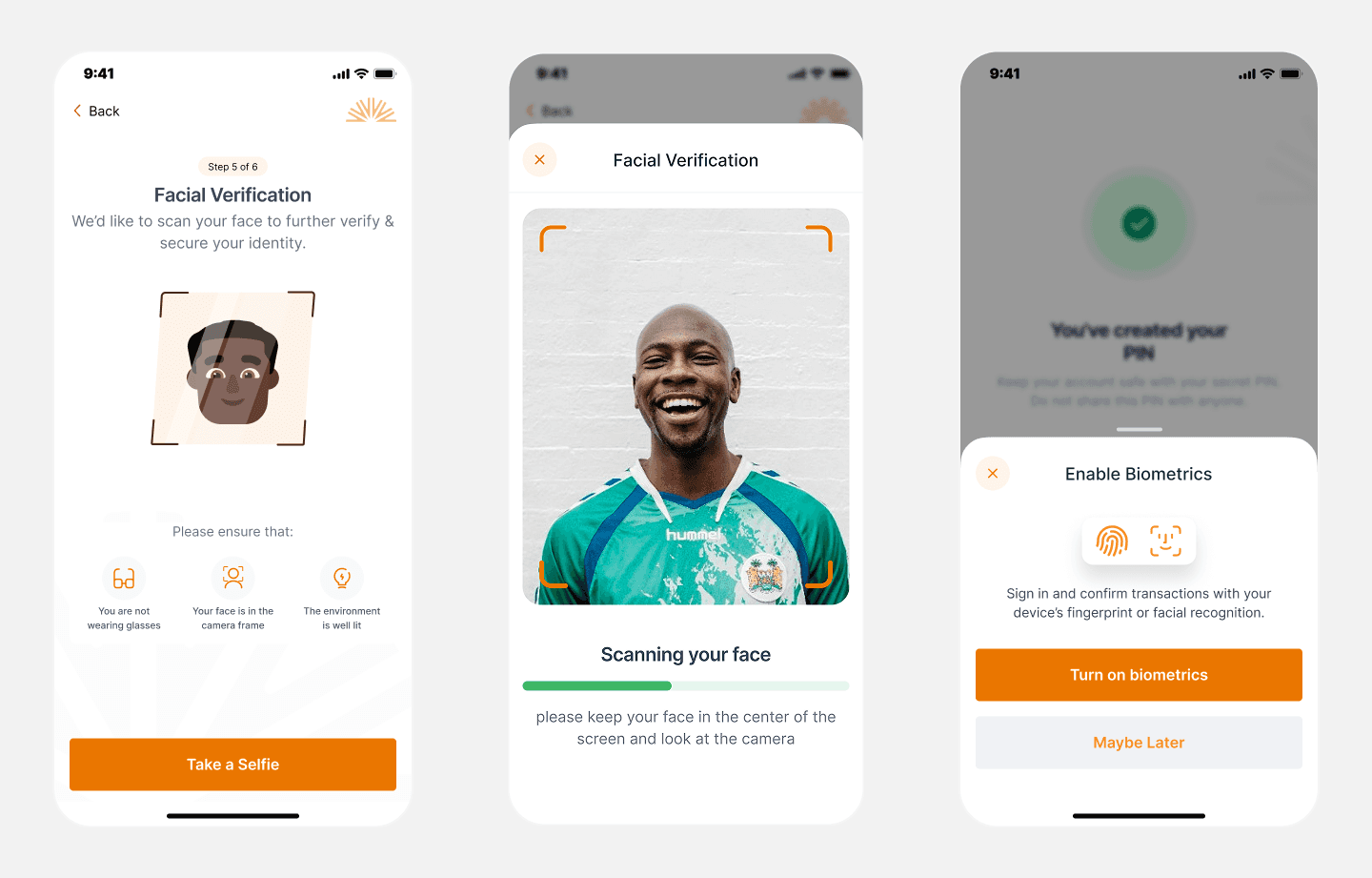

Onboarding

The onboarding process was redesigned to build trust from the with clear instructions and visual feedback. Phone number verification, identity checks, and PIN setup were made simpler and more secure, ensuring users feel safe while signing up. The new flow helps first-time and experienced digital banking users complete registration easily and start using the app within minutes.

Send Money

The transfer flow allows users to send money easily on Accionmonie to Accion account and other Nigerian banks. Prominent bank logos, smart autofill, and real-time validation reduce errors along confirming transactionnwith their PIN for security.

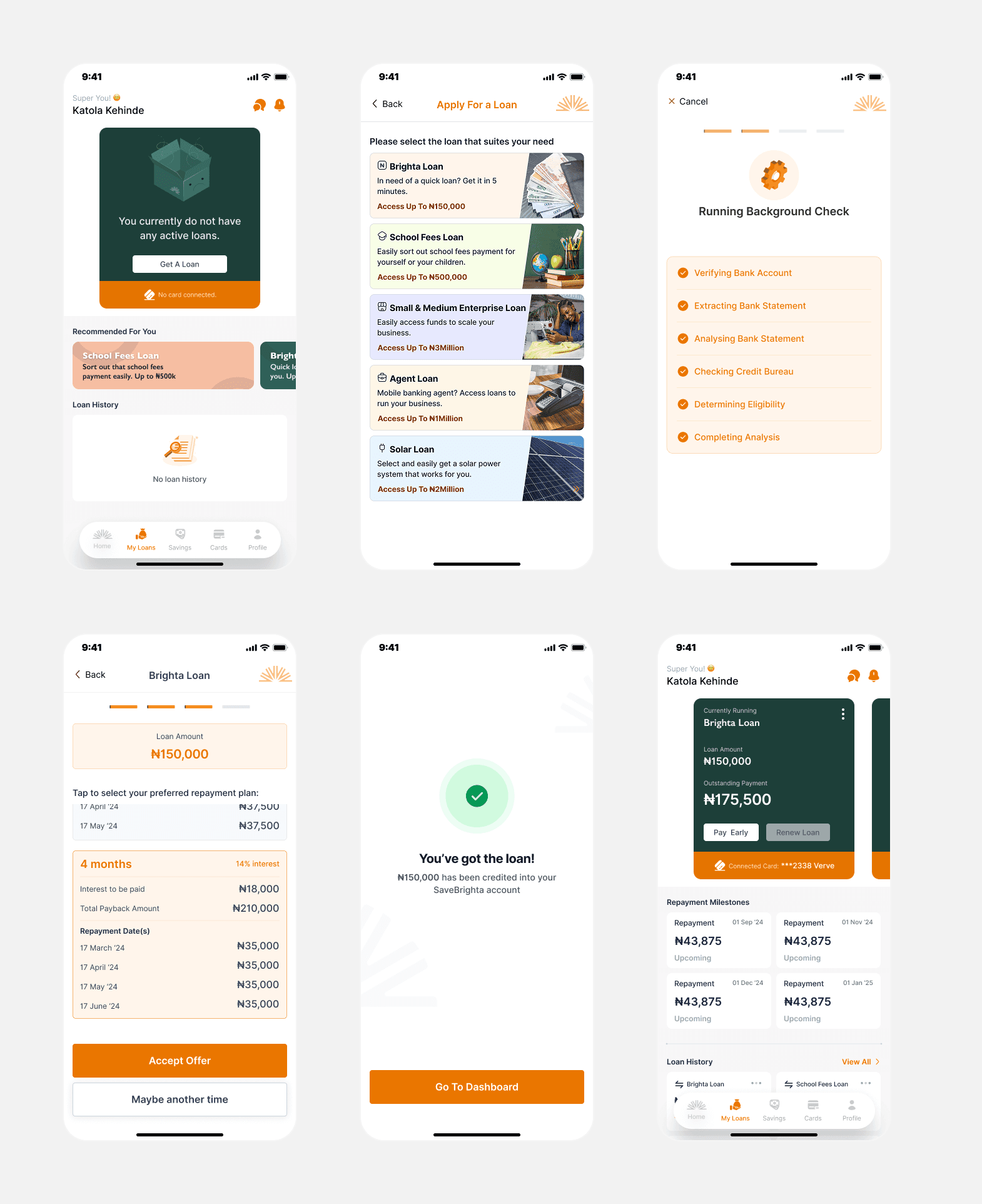

Loans

The previous loan process on AccionMonie required users to visit a branch or speak to an agent, creating friction and delays which led to low poor adoption. During the design, we focused on simplifying access and improving clarity.

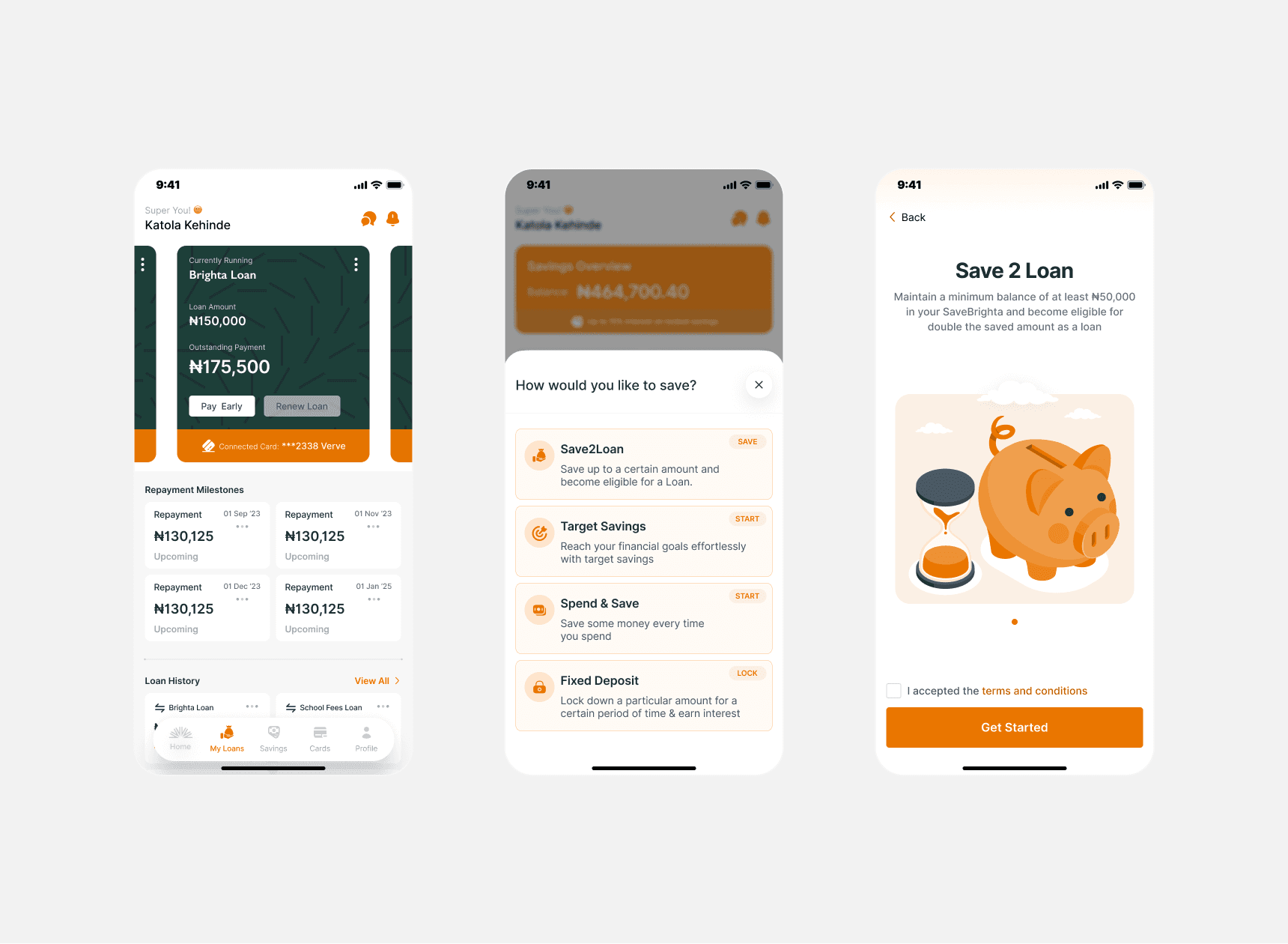

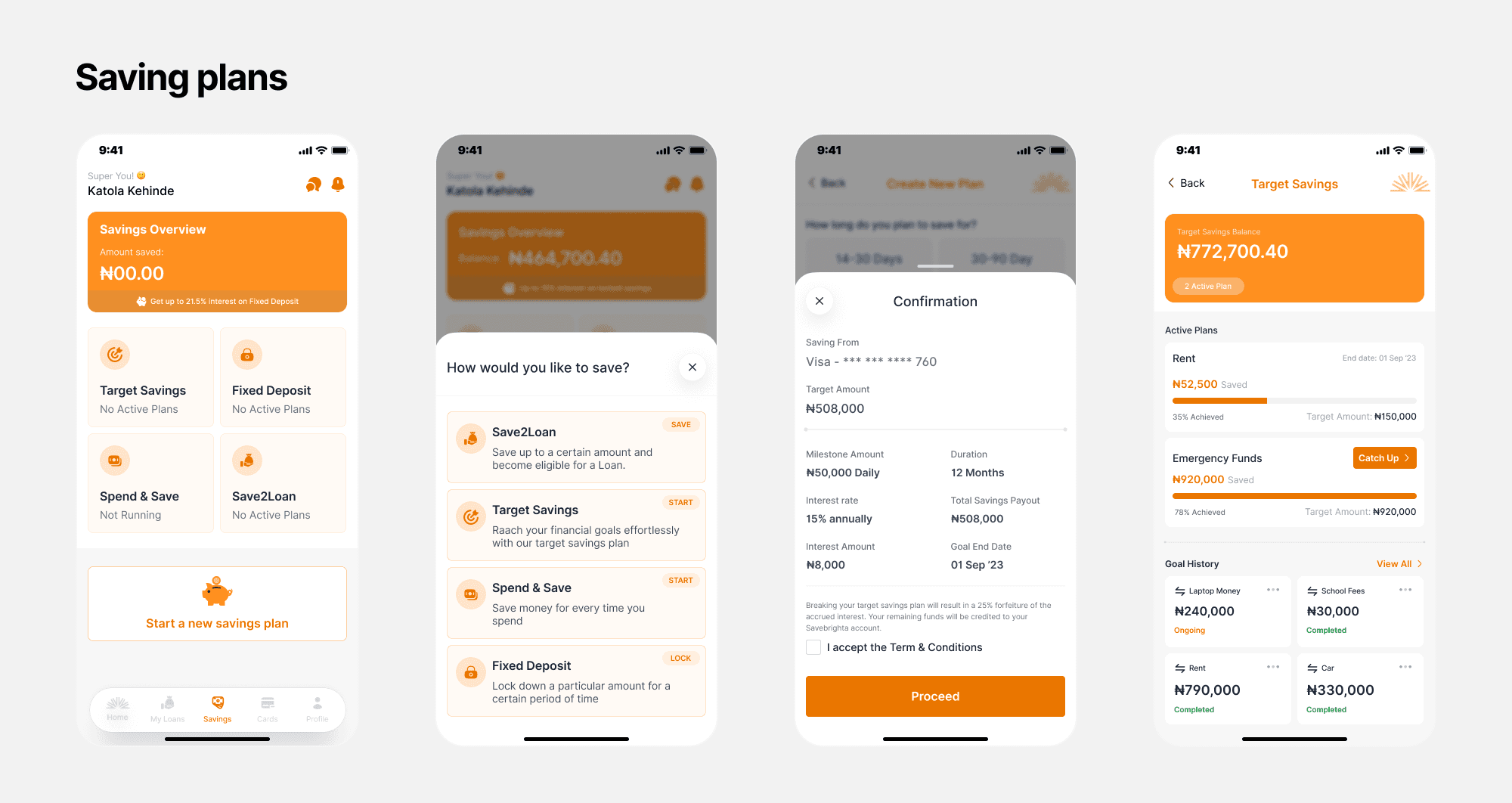

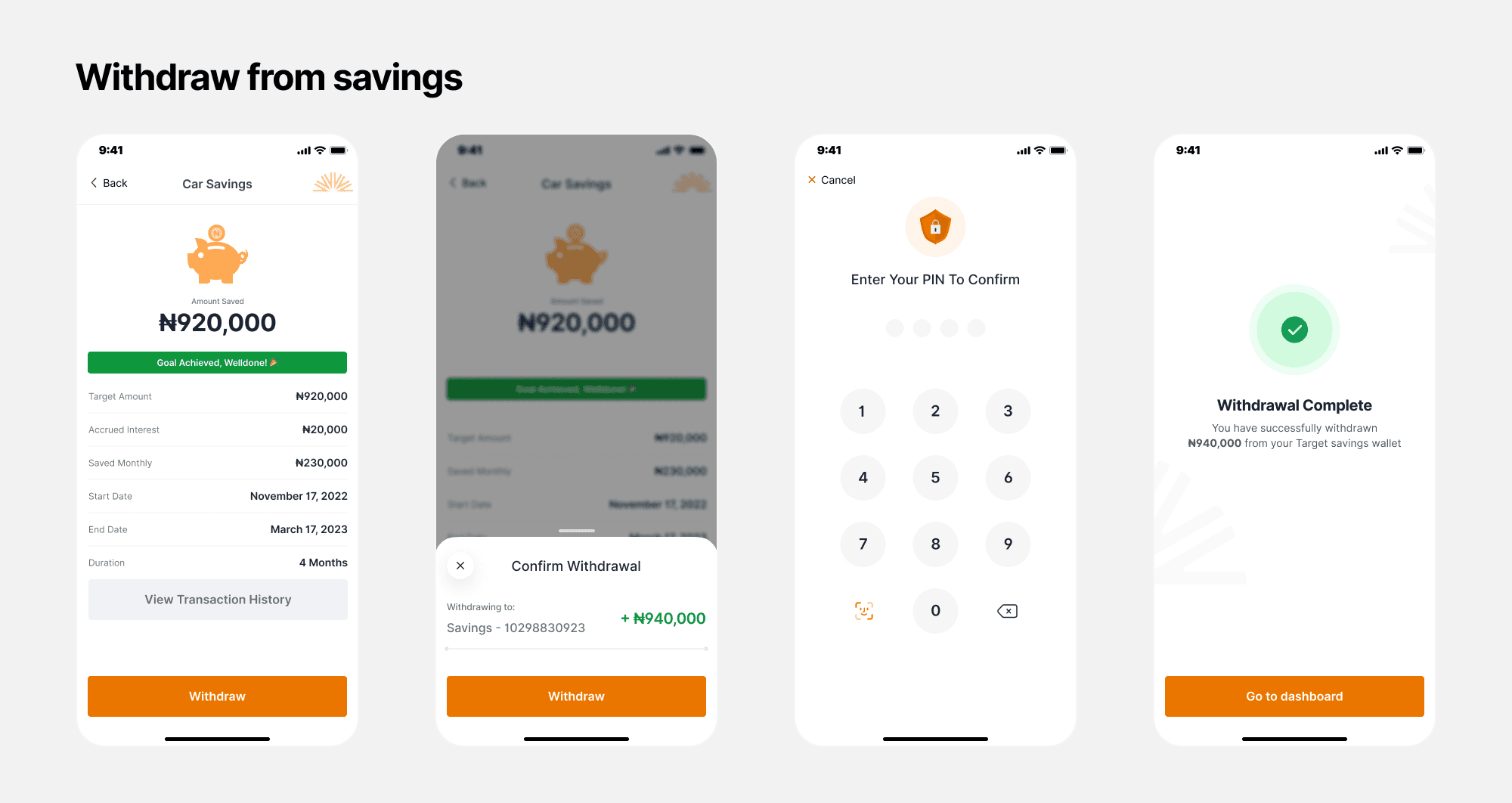

Savings

The savings feature on AccionMonie was designed to give users flexible ways to build financial discipline. From Spend and Save, Save2Loan, Target Savings, and Fixed Deposit, each plan was designed to help users save according to their goals and income patterns, making saving feel more personal and achievable.

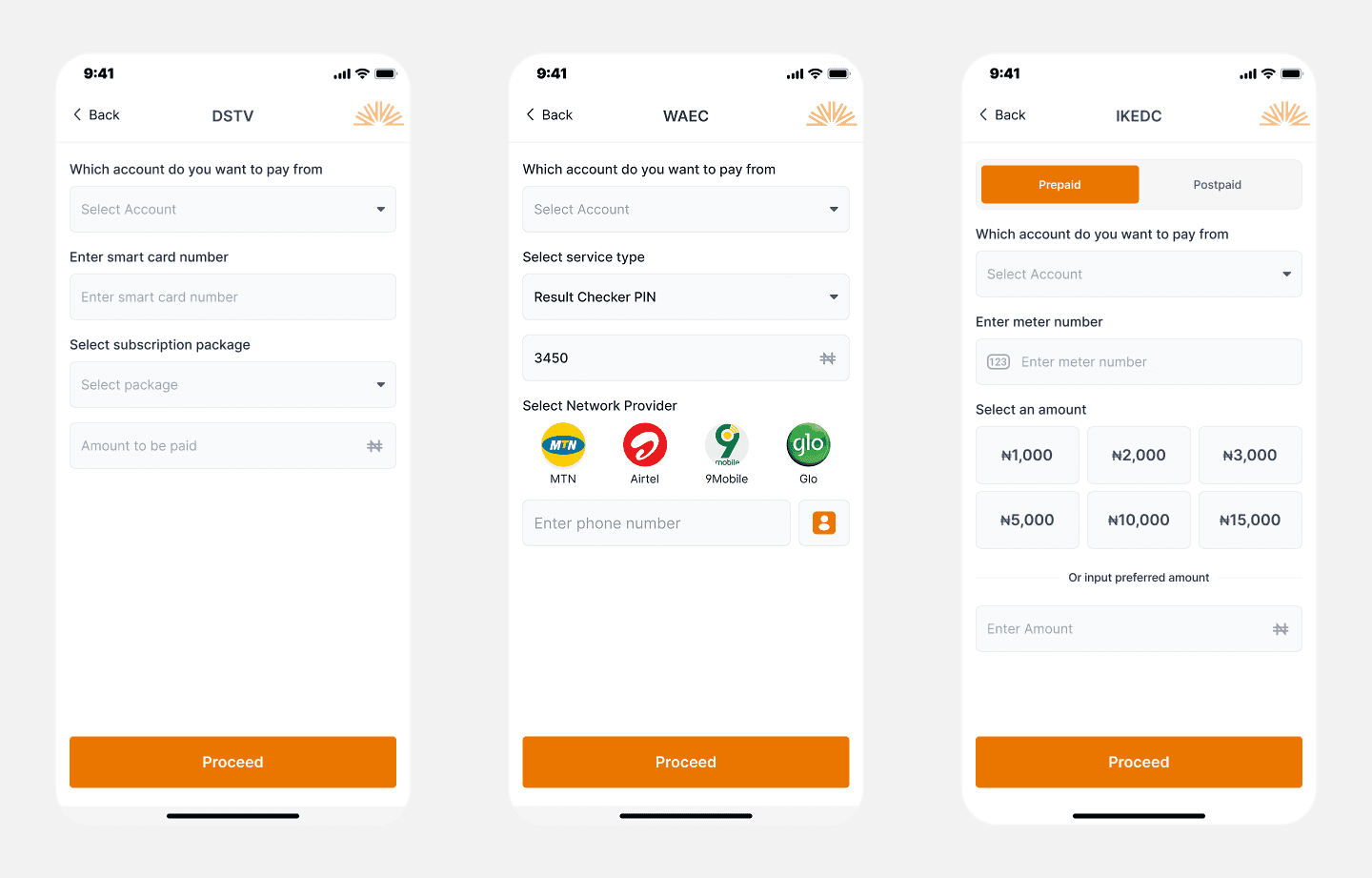

Bills Payment

The Bills Payments section on AccionMonie brings everyday essentials into one simple hub. Users can pay for Cable TV, Electricity, and Education services without leaving the app, turning what used to be a time-consuming and visit to offices into a quick experience.

Facial Verification and Biometrics

To build user trust and reduce fraud, we integrated facial verification and biometric authentication into the mobile app. Facial verification ensures secure identity validation within seconds, replacing manual checks with a faster, more reliable experience. Once verified, users can enable biometrics such as fingerprint or face unlock for instant, secure access to their accounts.

New Website

The former accion website was outdated and a maze for users to navigate or find any useful information they needed along with not meeting the regulation of the central bank of Nigeria. This new update was designed to solve the following problems and update the visual expreince of AccionMFB on the website touchpoint.

Impacts and results

556% increase in loan disbursements in two months

After launch, downloads crossed 10,000. In just two months, the bank saw a 556% increase in loan disbursements through the app. Over ₦10 billion in transaction value has now been processed digitally, and thousands of customers who previously relied on in-person services are now using the mobile app with confidence.

Team Members

I worked with

Team Structure: My Role (Lead Product Designer) 1 Product Manager – Oversaw project roadmap, priorities, and feature rollout. 1 Assistant Designer – Supported in visual consistency, component updates, and UI refinements. 5 Developers – Handled frontend and backend implementation, ensuring performance and reliability across devices.